* House GOP agrees on short-term deal to keep government open through Oct. 31

* Debate continues on odds that Fed can engineer a US ‘soft landing’

* Country Garden’s struggle to survive is China’s biggest property crisis to date

* Peak rates are expected to be near for major central banks

* Rising number young adults have given up on owning a home

* Median US home sales price rose 3% in Aug vs. year ago–biggest gain since Oct

* Net 51% of US banks tightening lending standards–highest since 2020

* US industrial production rises more than expected in August

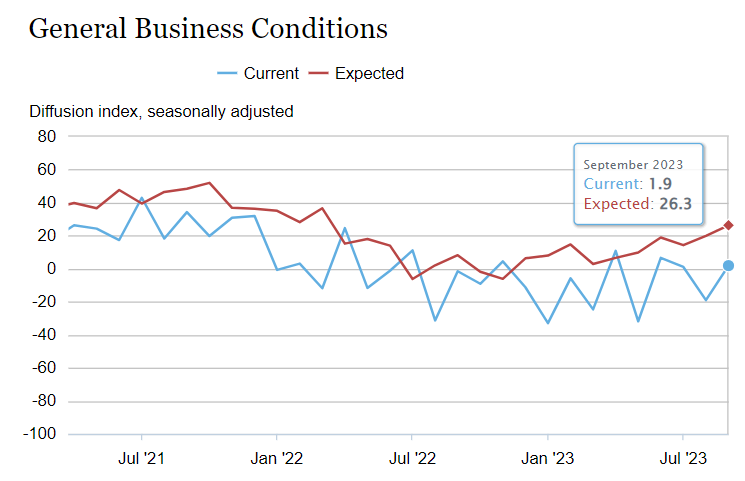

* NY Fed Mfg Index survey: firms “more optimistic” in Sep. for 6-month outlook:

The US dollar is trading near a 6-month high ahead of Federal Reserve meeting on Wednesday. “In the grand scheme of things we’re quite positive on the dollar,” says Alvin Tan, head of Asia FX strategy at RBC Capital Markets. “The US economy is outperforming both Europe and Asia, especially China.” Although the market expects the Fed to leave rates unchanged at the current 5.25% to 5.5% range, Tan says that there’s a possibility for more hikes down the road. “There’s a very strong consensus for a pause here,” he explains. “But there seems to be an expectation that we could see some hawkishness through the latest dot plot (of policymakers’ rate expectations), given how resilient the U.S. economy has been.”