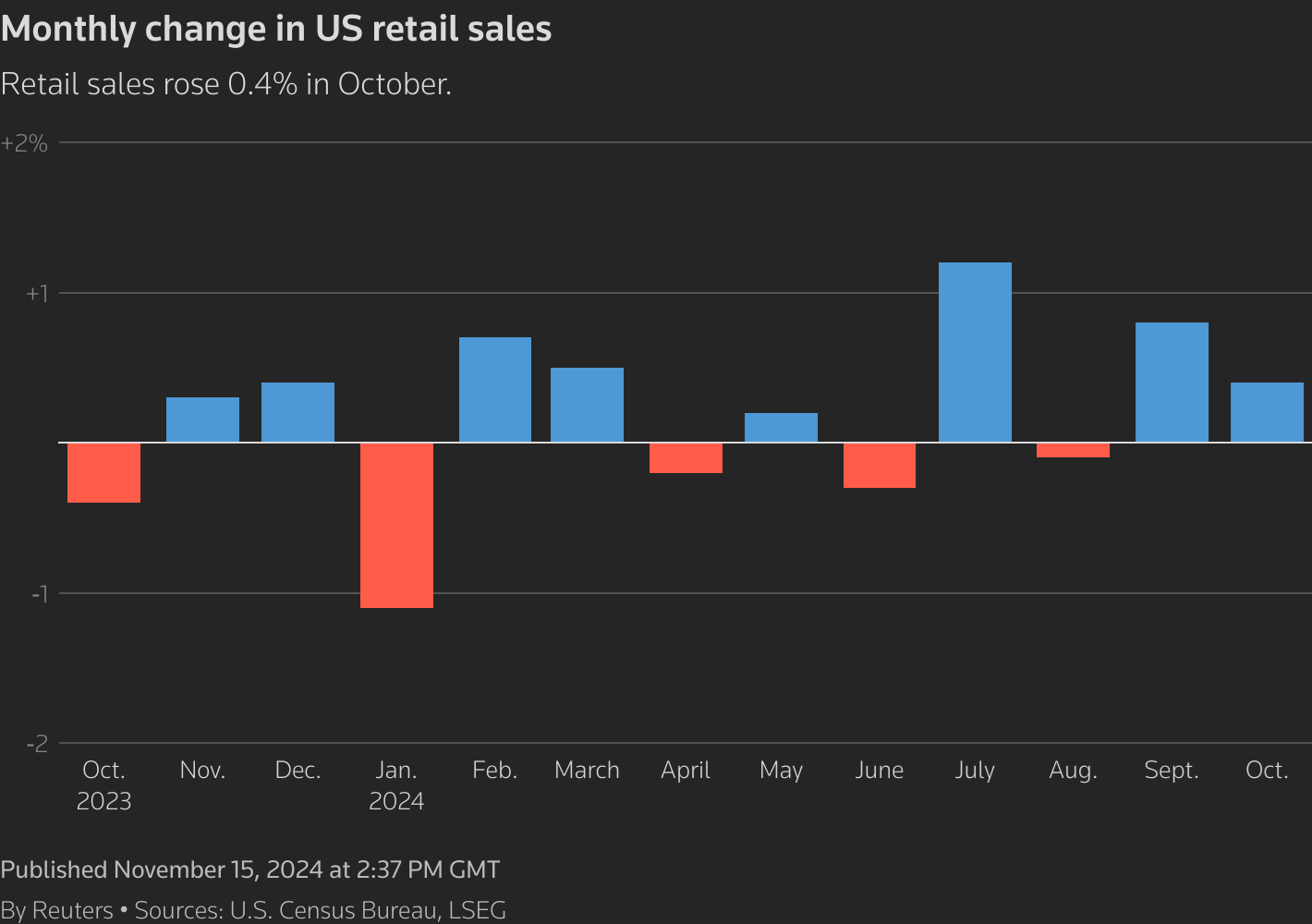

US retail sales rose more than expected in October, reviving doubts about the wisdom of additional rate cuts. “Retail sales data [in October] make many in the markets wonder if another rate cut at the December meeting is warranted at all,” says Christopher Rupkey, chief economist at FWDBONDS. “With fiscal policy expected to shift into high gear on the pro-growth stimulus side, perhaps the Fed’s monetary policy should not be putting another log on the fire to fuel growth by lowering rates, as it could lead to a return of inflation.”

US stock market valuation rises to more than double its average level based on the past 150 years. The 38-plus reading for the Shiller P/E is a rare event during a bull market, reaching that height only three times since 1871.

US industrial production fell in October, reportedly due in part to temporary effects from hurricanes and a Boeing strike. Output fell 0.3%, marking a second straight monthly decline.

US import prices unexpected rose 0.3% In October. “Import prices surprised to the upside in October, with a larger than expected rise in fuel prices driving the gain,” says Matthew Martin, senior US economist at Oxford Economics. “Given the downward trend in oil prices in recent weeks, the increase will be reversed in next month’s report.”

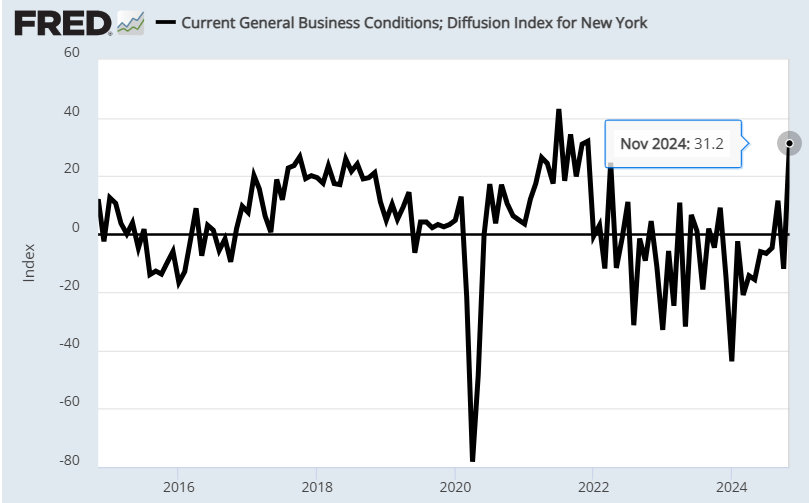

NY Fed Manufacturing Index soars in November. The regional benchmark rose to 31.9. This month’s reading marks the highest level in nearly three years.