* Russia’s war against Ukraine looks increasingly like terrorism

* US retail sales rose more than expected in June

* Fed officials signal they are likely to raise interest rates by 0.75 percentage point

* Economic pain is sweeping across Europe (and Russia)

* Consumer sentiment ticked up in July but remains near record low

* US industrial output fell in June–first monthly decline this year

* Earnings season off to slow start, adding new headwind for stocks

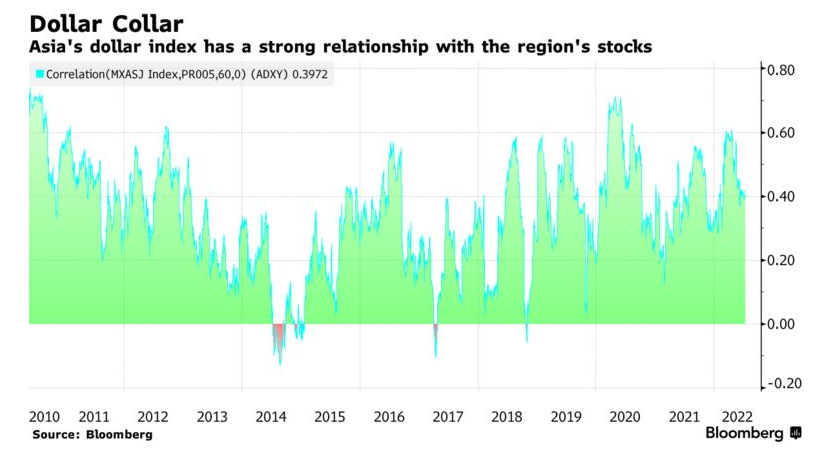

* Strong dollar could help the Fed fight inflation

* Mixed jobs data lift uncertainty for US labor market outlook

* Real wage growth is taking a hit from inflation:

More central banks are leaning toward large rate hikes. “We’re seeing a rate hike feeding frenzy,” says James Athey, a senior portfolio manager at investment firm Abrdn. “It’s the reverse of what we saw in the last decade . . . Nowadays the last thing anyone wants is a weak currency.”

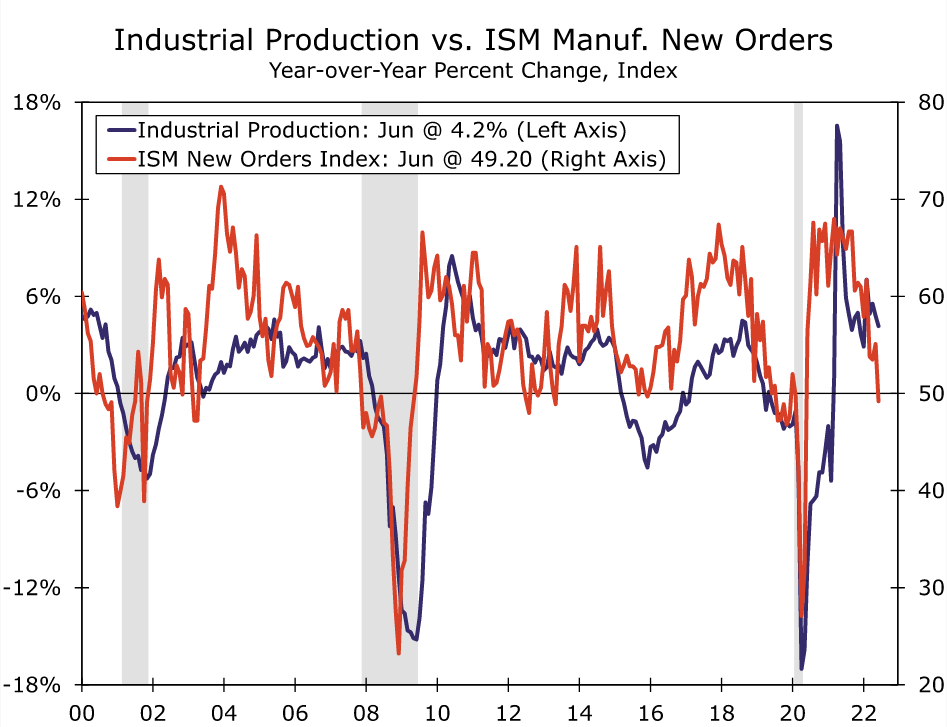

US manufacturing activity is slowing faster than expected, economists at Wells Fargo advise. “Factory output fell 0.5% in June, much more than the 0.1% dip that had been expected. Revisions bit hard in manufacturing with last month’s 0.1% dip getting swapped out with a 0.5% decline. Dipping from an all-time high in April, the level of manufacturing output is now back to 2018 levels… A slowdown in production is traditionally consistent with a broader slowdown in demand and signals to the Fed that tighter policy is having the expected effect on activity.”

Strong dollar threatens to trigger additional outflows from Asia’s emerging-market shares. “The dollar is strengthening because there’s risk aversion rather than growth,” says said Zhikai Chen, head of Asian equities at BNP Paribas Asset Management. That’s “not a good mix” for Asian assets, he tells Bloomberg.