* Chinese leader restates support for Russia on “sovereignty and security” matters

* Three European leaders visit Ukraine as US pledges $1 billion in new security aid

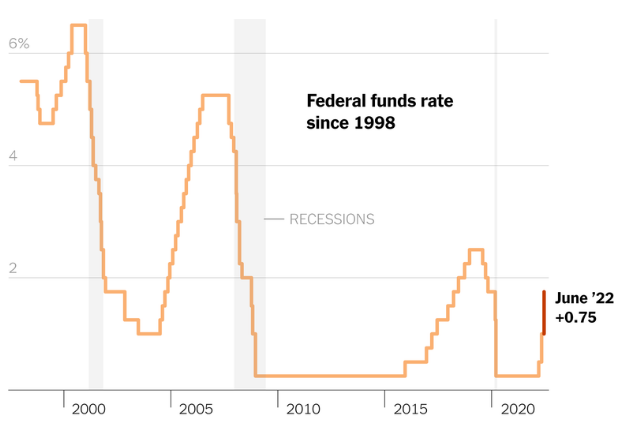

* Federal Reserve hikes interest rates 3/4 percentage point

* Business inflation expectations are relatively steady in June

* NY Fed Mfg Index reports second month of contraction in June

* US homebuilder sentiment falls to two-year low in June

* US retail sales fall in May, posting first monthly loss this year:

Federal Reserve’s 3/4-percentage-point rate hike is largest increase since 1994. “We’re not trying to induce a recession right now, let’s be clear about that,” Fed Chair Jerome Powell says. Kathy Bostjancic, chief US economist at Oxford Economics, explains: “What Powell and the rest of the FOMC are saying is that restoring price stability is the primary focus — if they risk a mild recession, or a bumpy soft landing, that would still be successful. The focus is greatly on inflation right now.”

The bull market for US stocks ended this week after just 21 months. That’s the short bull run on record since the end of World War II, reports LPL Research. It was also the quickest doubling:

Will the Fed’s ongoing rate hikes lead to recession? History isn’t encouraging, based on aggressive tightening cycles, which usually lead to economic downturns.