* Russian fighter jet collides with US drone over Black Sea

* Regional bank stocks rise, recovering some of Monday’s sharp losses

* Moody’s cuts view on entire banking system to negative from stable

* Fed will consider tougher rules for midsize banks after SVB collapse

* SVB collapse fueled by ‘the first Twitter-fueled bank run’

* Should Congress raise cap on deposits backed by the FDIC?

* China’s economy rebounds after Covid lockdown

* US consumer inflation continues to ease in February via 1-year change:

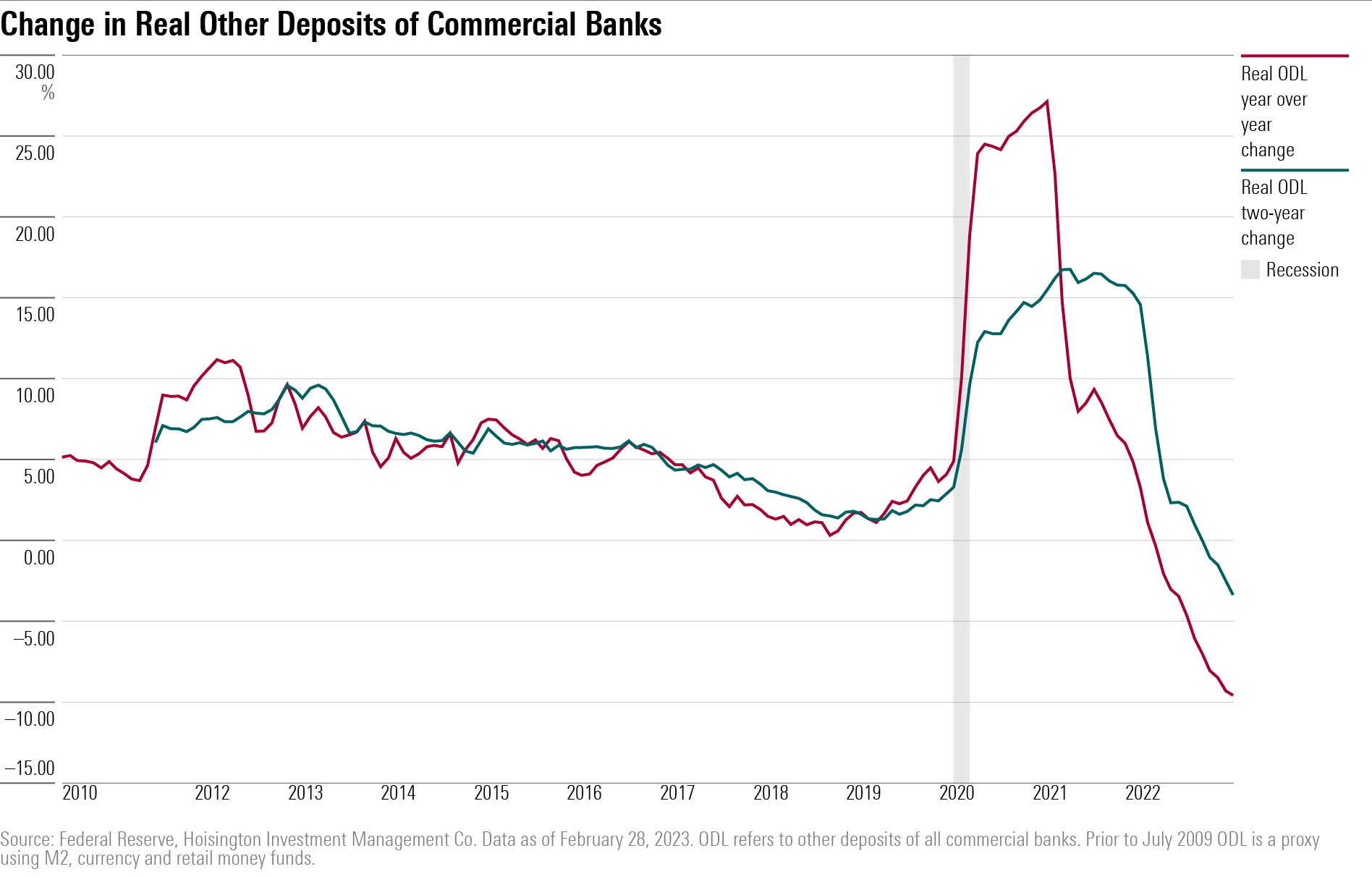

Lacy Hunt, economist at Hoisington Investment Management and a long-time bond bull, continues to see opportunity for owning government bonds. In an interview with Morningstar, he outlines his case that recession and liquidity risk remain risk factors for the economy. He also expects inflation will continue to ease. “The Fed created this huge mountain of liquidity in 2020 and 2021,” he says. “They now have a vacuum cleaner on it … sucking out the liquidity and as it comes out of the vacuum cleaner and goes into the incinerator. The process is underway.” He adds: “I think we’ll see the inflation rate begin to unwind and we’ll make considerable progress and moving toward the Fed’s target toward the end of the year.” He concludes: “The past year and a half has been very difficult for those of us who are optimistic” about the bond market, but in the current environment “I don’t think it’s a reason to surrender the view that ultimately the trending interest rates are lower.”