* Fed official says central bank can’t risk being late with rate cuts

* Japan’s GDP rises more than expected in Q2

* China industrial growth slows to four-month low in July

* Cisco will cut 7% of its global workforce

* US headline consumer inflation dips under 3% for first time since 2021:

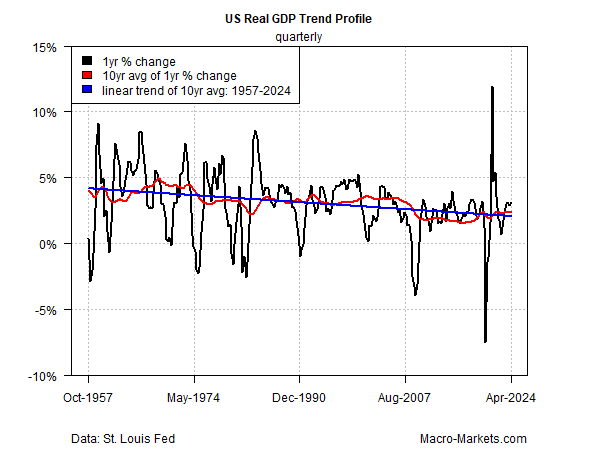

A challenging macroeconomic climate awaits the next US president on two fronts: a long-running downtrend in economic growth amid rising federal debt, explains a new research note from TMC Research, a division of The Milwaukee Company. “The rate of growth in real gross domestic product (GDP) has been trending lower over much of the past half-century-plus. During shorter periods it’s easy to overlook the deceleration, which can and has given way to relatively firmer growth for short periods. But profiling GDP across the years shows a clear downtrend.” At the same time, federal debt in relative and absolute terms has increased sharply. These twin events will likely force the White House and Congress to confront the challenge to a degree that the current government has not.