* China conducts military drills around Taiwan as US lawmakers visit

* US will roll out new Taiwan trade support and conduct air, sea transits

* China cuts interest rates as economic slowdown deepens

* Will Fed’s Powell outline new thinking on quantitative tightening at Jackson Hole?

* US employers struggle to find workers

* Most traders see a recession starting this year, survey finds

* US consumer sentiment rebounds in August, rising to 3-month high:

Will last week’s modestly encouraging inflation news materially change the Fed’s hawkish policy in the near term? Probably not, predicts Joseph Brusuelas, chief economist at RSM. “It does appear that a tentative peak in inflation is in place. I think that the July inflation does nothing to alter the path of Fed policy, and any notion that a Fed pivot is at hand should be dismissed,” he tells CNBC. “We are some months away from any potential clear and convincing evidence that inflation is well on its way back to the 2% target that currently defines price stability.”

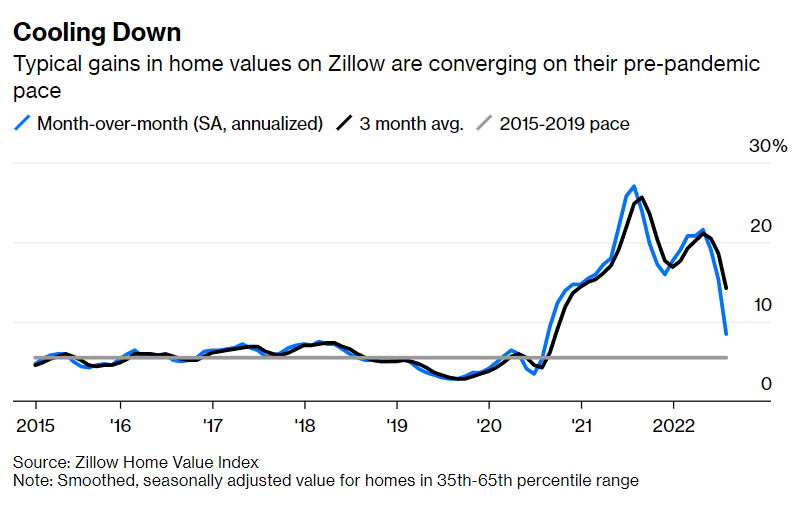

Will the deceleration of US house prices turn into a crash? Much depends on inflation’s path in the months ahead, how fast and far the Fed lifts interest rate and how the economy fares, writes Bloomberg’s Jonathan Levin.

US stocks post best rally of the year as inflation eases via July update on consumer prices. “The peak of freaking out about inflation and interest rates is done, and we are looking at something that is not quite as dramatic,” says Michael Purves, founder and chief executive of Tallbacken Capital.

High-yield bond defaults are expected to rise as central banks raise interest rates, Fitch predicts. The ratings agency advises that junk bond default rates could double in the US in 2022 vs. last year, rising to 1%. Default rates may double in Europe, too, to 1.5%. “Over the next five years, I think you see a 4% default rate a year, so in a five-year span, one in five will default in high yield. It’s a lot,” says Pierre Verle, head of credit at European asset manager Carmignac. “I don’t expect an uncontrollable wave of defaults. But we’re re-entering a world where capital has a cost.”