* Scalise withdraws from Speaker race, leaving House in limbo

* Would wider war in Middle East tip world economy into recession?

* Oil prices jump after US tightens sanctions on sales of Russian crude

* US jobless claims remain steady, holding near multi-decade low

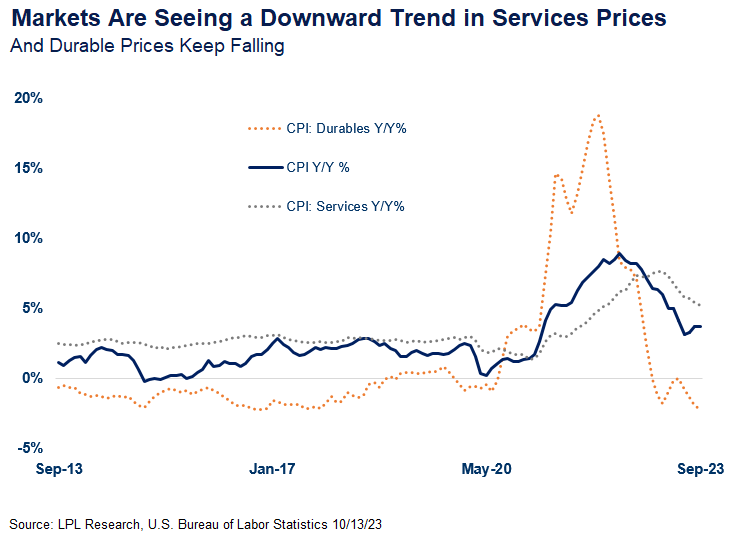

* US consumer price inflation unchanged at 3.7% annual pace in September:

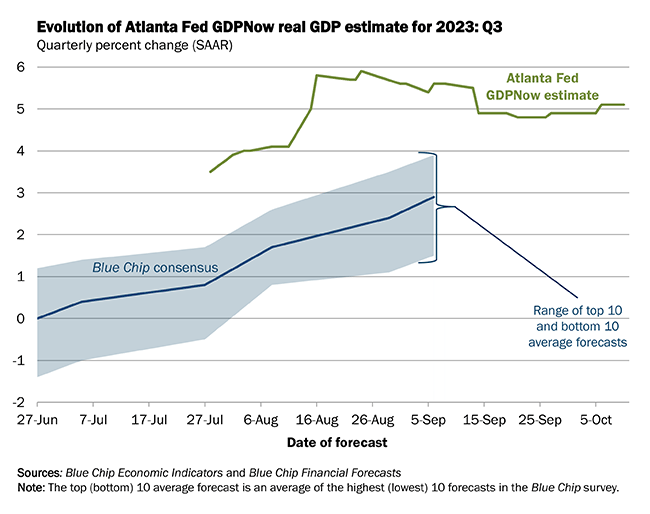

A recession is needed to lower inflation to the Federal Reserve’s 2% target, predicts Steven Blitz, chief US economist at GlobalData TS Lombard. “You need a recession. You’re not going to magically get down to 2%,” he tells CNBC. “The forces that are driving the disinflation among the various bits and micro pieces of the index eventually give way to the broader macro force, which is rising, which is above-trend growth and low unemployment. Eventually that will prevail until a recession comes in, and that’s it, there’s nothing really much more to say than that.” A US recession, however, still looks like a low probability for the near term. The Atlanta Fed’s GDP Nowcast (as of Oct. 10) for the upcoming third-quarter GDP report, for instance, is a strong 5.1% increase — more than double the 2.1% rise reported for Q2.