* Fed Chair Powell may face choice between inflation or recession

* Another Fed rate hike expected this week, and more to come

* “Ferocious” outbreak of Covid in Beijing raise doubts about China’s reopening

* UK economy contracts for second month in April

* US dollar’s rise to 20-year high translates to hefty losses for US Firms

* The worst of the global food crisis may lie ahead

* Bitcoin falls below $24,000, lowest since Dec. 2020

* Consumer sentiment in US slumps to record low in early June

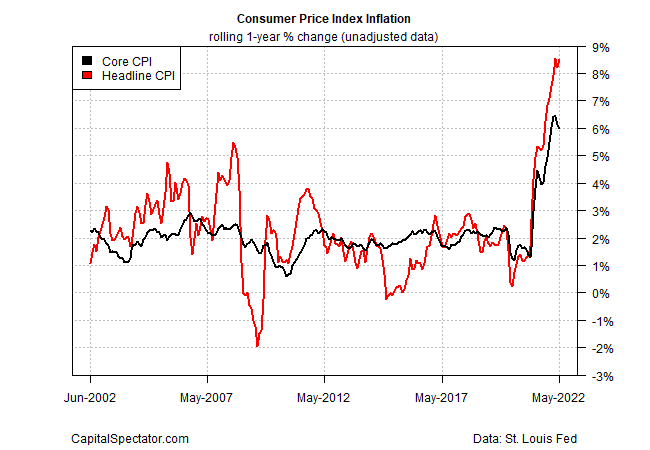

* US consumer inflation rises to annual rate of 8.6% in May, a 40-year high:

Demand destruction is starting to emerge in the consumer sector, based on the BMO Real Financial Progress Index, a quarterly survey conducted by BMO and Ipsos that measures Americans’ sentiment around financial confidence. “More than a third of Americans (36%) have reduced their savings and 21% cut back on their retirement contributions due to inflation, according to BMO Real Financial Progress Index results published at the end of May,” a recent press release notes. “80% of Americans surveyed plan to change their actions to offset the impact of inflation and rising costs of everyday essentials,” including: 46% are either dining out less or consciously spending less when dining out.; 31% are driving less to offset the soaring cost of gas; and 23% are spending less on vacations or canceling them altogether.

Can the US still avoid a recession? “The path toward a soft landing is a very narrow one — narrow to the point where we expect a recession as the baseline,” predicts Matthew Luzzetti, chief US economist at Deutsche Bank. But for now, the resilient consumer sector is probably keeping the expansion alive, despite high inflation and rising interest rates. “There continues to be deep pockets of pent-up demand,” advises Anthony Capuano, chief executive of Marriott International. “Unlike previous economic cycles and economic downturns, here you have this added dimension, which was folks were locked down for 12 to 24 months.”

Majority of economists predict a US recession will start in the first half of 2023, according to a new poll. Nearly 40% of the 49 respondents expect the the National Bureau of Economic Research — the arbiter of US recession dates — will declare announced the start of a downturn at some point in the first six months of next year, advises a survey by the Financial Times and the Initiative on Global Markets at the University of Chicago’s Booth School of Business. A third of economists polled say the recession will start in the second half of 2023.