* US shoots down several aerial objects over North America

* Some economists consider possibility of an economic growth upturn for US

* Fears of a US debt crisis are overblown, writes economist Barry Eichengreen

* This week’s US consumer inflation data will test disinflation optimism

* Recession risk is lower due to labor hoarding, analyst reasons

* Will higher yields in Japan pull back assets invested overseas?

* US home prices set to fall further despite lower rates, says market expert

* Half of Americans say they’re worse off vs. year ago, survey finds

* US consumer inflation revised up for December

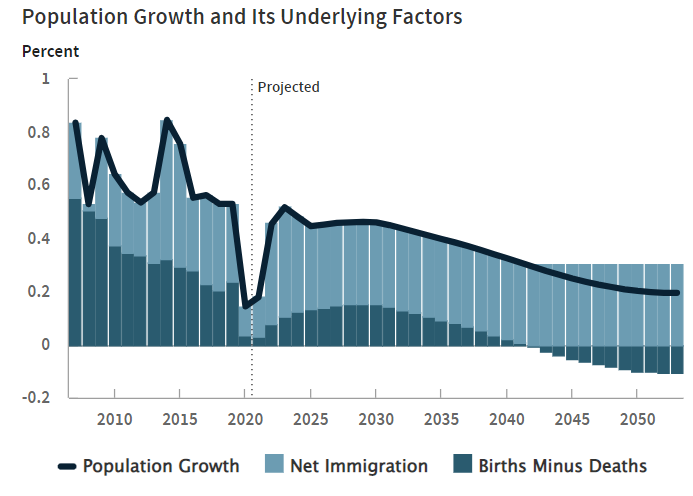

* Population growth in US is increasingly driven by net immigration, CBO projects:

Putin has “lost the energy war,” says one of the world’s top traders in this space. “Very high natural gas and power prices in Europe were extremely bad for the world economy but now they have come back to a more reasonable level,” Pierre Andurand, a former Goldman Sachs and Vitol energy trader, tells the Financial Times. “If gas prices stay here there will be much less worry about inflation and interest rates rises. There’s no more fear of an energy crisis,” advises the head of Andurand Capital. Now that Europe is getting used to living without Russian gas why would they ever go back?”