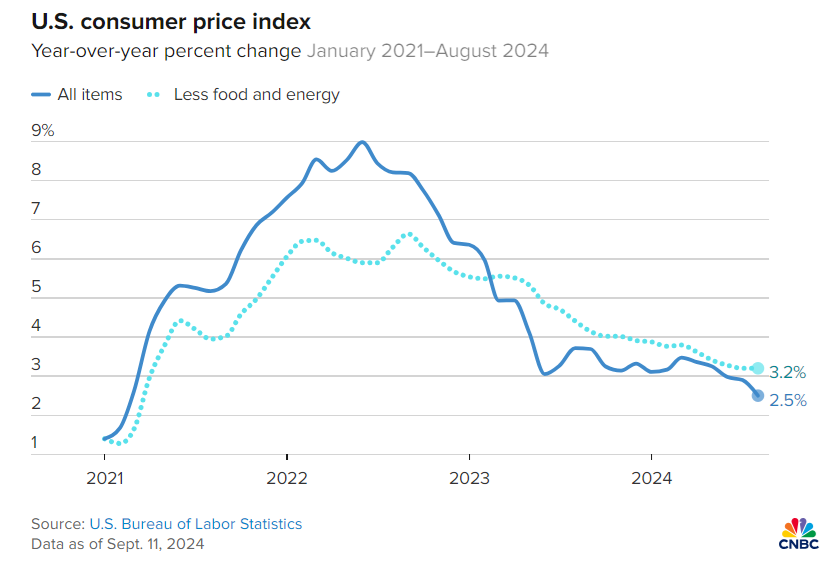

US consumer price inflation at the headline level eased to a 2.5% year-over-year pace in August, the slowest in 3-1/2 years. Core CPI, however, remained sticky at 3.2%, unchanged from the previous month. “This isn’t the CPI report the market wanted to see. With core inflation coming in higher than expected, the Fed’s path to a 50 basis point cut has become more complicated,” says Seema Shah, chief global strategist at Principal Asset Management. Sarah House, senior economist at Wells Fargo, advises: “Inflation continues to decelerate on tend, but we’re seeing it take longer for some of the impact of the pandemic to fully unwind.”

Fed funds futures continue to price in a high probability of rate cut at the Sep. 18 FOMC following yesterday’s US consumer inflation report. The market this morning is assigning an 85% probability for a 1/4-point cut and 15% for a half-point cut.

Western firms’ confidence in doing business in China wanes, according to an annual surveys by the European Union Chamber of Commerce in China and the American Chamber of Commerce in Shanghai. “The risk of doing business in China has gone up in the past few years and at the same time the market is slowing down,” says Eric Zheng, president of the US group.

China threatens to retaliate over US bill that may lead to closing of Hong Kong’s US-based trade offices. The legislation was passed on Tuesday in the House with bipartisan support. If the Senate approves it and president signs it into law, the bill would require the US secretary of state to annually review the “privileges, exemptions and immunities” given to Hong Kong’s Economic and Trade Offices.

Ahead of next week’s expected announcement by the Federal Reserve that it will cut interest rates, investors are considering how previous rate-cutting cycles influenced equity prices. Stock market performance “can vary dramatically in the year after a new easing cycle starts,” Morningstar reports. “The Morningstar US Market Index rose more than 21% in the 12 months following the beginning of the Fed’s 1995 easing cycle, as the economy achieved a rare soft landing. But returns cratered more than 10% when the Fed began cutting rates in 2001 as the dot-com bubble burst.”