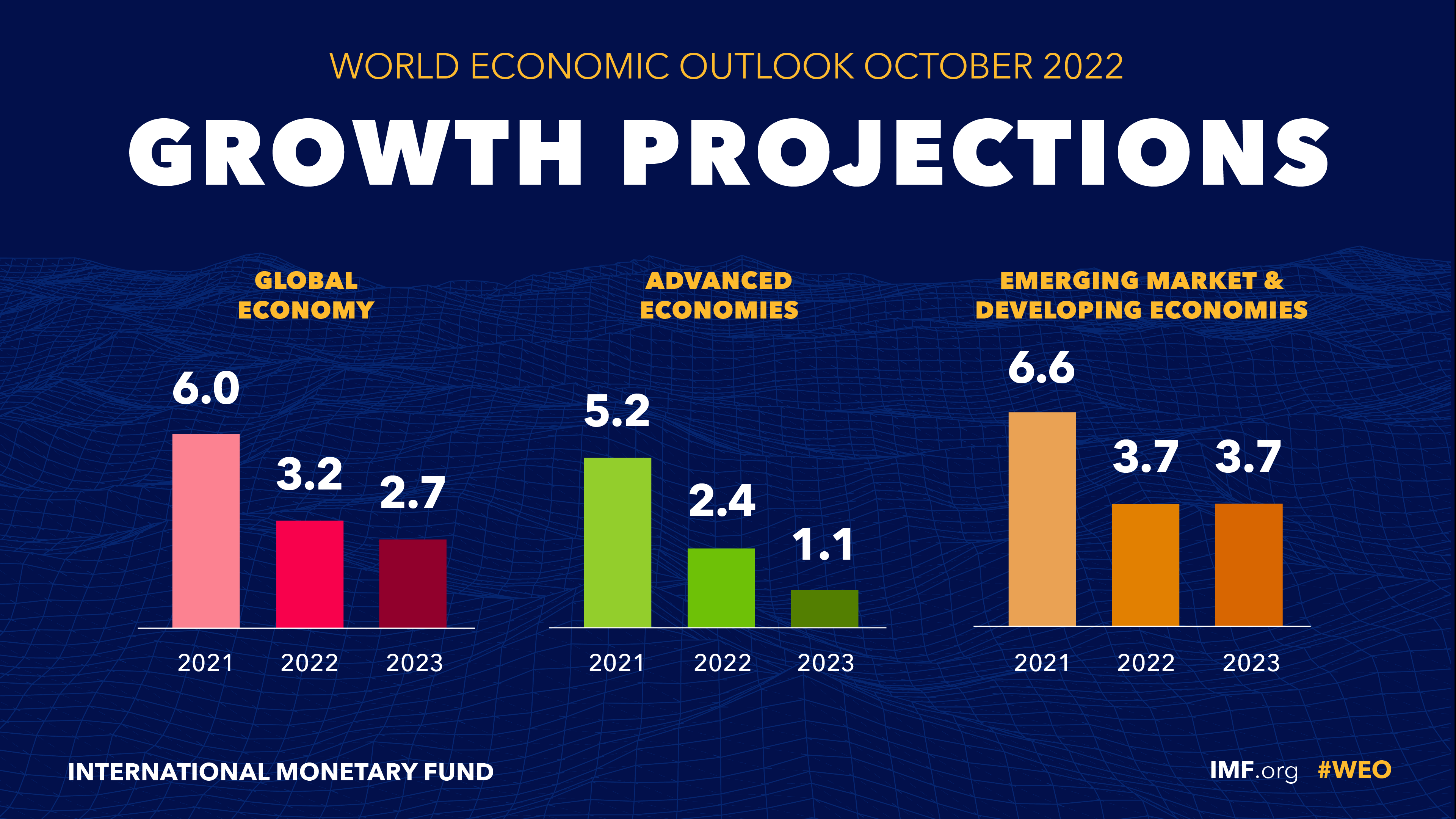

* IMF issues warning on global economic outlook

* Weak economic outlook implies lower inflation, analysts advise

* Strong dollar is ‘logical outcome’ of policy decisions, says Treasury Sec. Yellen

* UK economy contracts in August, a downside surprise to forecasters

* Long-term inflation outlook suggests relatively mild pricing pressure

* US small business sentiment rises modestly for third month in September:

Central banks may be misreading the potential for inflation to recede, says Maurice Obstfeld, former chief economist at the International Monetary Fund. “Just as central banks misread the factors driving inflation in 2021, they may be underestimating the speed with which inflation could fall as their economies slow. By simultaneously all going in the same direction, they risk reinforcing each other’s policy impacts without taking that feedback loop into account. The highly globalized nature of today’s world economy amplifies the risk.”

“The worst is yet to come, and for many people 2023 will feel like a recession,” the IMF predicts in its new World Economic Outlook report. “Next year is going to feel painful,” Pierre-Olivier Gourinchas, the IMF’s chief economist, tells CNBC. “There’s going to be a lot of slowdown and economic pain.”