* Biden urged to ban imports of Chinese-made electric cars to US

* IMF chief warns central banks against cutting interest rates too soon

* Gold rallies above $2400/oz.

* China’s exports fell sharply in March in US dollar terms

* US jobless claims fell last week, holding near multi-decade low

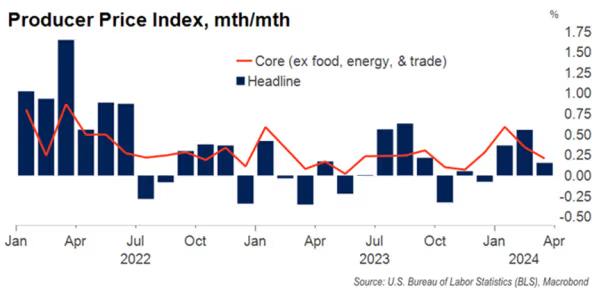

* US producer price inflation rises less than expected in March:

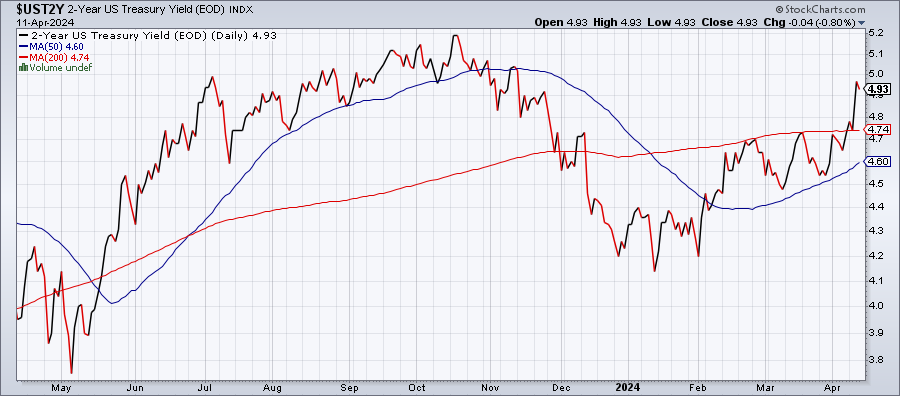

Two Fed officials offer encouraging words about rate cuts after hotter-than-expected consumer price inflation data for March. “I expect inflation to continue its gradual return to 2%, although there will likely be bumps along the way, as we’ve seen in some recent inflation readings,” said New York Fed president John Williams. Boston Fed president Susan Collins advised: “Overall, the recent data have not materially changed my outlook, but they do highlight uncertainties related to timing, and the need for patience. It may take longer to discern whether the economy is sustainably on a path back to 2% inflation, and thus less easing of policy this year than previously thought may be warranted.” Meanwhile, the policy-sensitive US 2-year Treasury yield ticked lower on Thursday (Apr. 11) after rising to a 5-month high: