* Treasury Sec. Yellen says US will probably avoid a recession

* US gasoline price average approaching $5 a gallon

* Rising fuel costs rippling across industries and affecting consumer behavior

* China consumer inflation is stable in May as factory-gate prices ease

* ECB says it will raise interest rates next month–first time hike in 11 years

* FTC chair issues a regulatory warning to the tech industry

* Big US banks look set for earnings boost from pickup in credit card use

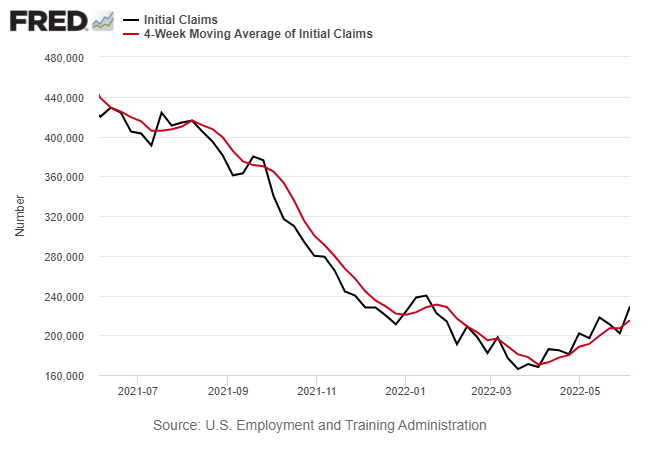

* US jobless claims rise to five-month for week through June 4:

US housing market the “most significant contraction in activity since 2006,” advises Freddie Mac economist in a tweet. “It hasn’t shown up in many data series yet, but mortgage applications are pointing to a large decline over summer. Purchase apps down 40% from seasonally adjusted peak.”

US inflation will stay high but has probably peaked, says Ellen Hazen, chief market strategist at F.L.Putnam. “Don’t expect inflation to come down anytime soon, she advises. “We think that inflation has probably peaked and will be declining toward the rest of this year,” she told Yahoo Finance Live. “The reason for that is that companies have a wide variety of different factors leading to inflation. There are higher labor costs. There are higher fuel prices, higher transport and logistics prices, higher commodities prices, and some of these are going to come off, but they won’t come off all at the same time.”

Most Americans expect inflation to worsen, new poll finds. Two-thirds of Americans think inflation to get worse in the year ahead, while only 21% expect it to get better and 12% see no change on the horizon, according to a recent poll conducted by The Washington Post and George Mason University’s Schar School of Policy and Government.

The world economy should prepare for an ongoing surge in oil prices, analysts predict. FT reports: “JPMorgan’s chief executive Jamie Dimon thinks oil prices could surge to $175 a barrel later this year. Jeremy Weir, the head of commodity trader Trafigura, says oil could go ‘parabolic’.

Energy Aspects, a consultancy with clients stretching from hedge funds to state energy companies, says we are facing “perhaps the most bullish oil market there ever has been”. Goldman Sachs thinks oil prices will “average” $140 a barrel in the third quarter of this year.”