* Russia says oil flows to three central European nations have been halted

* Can Taiwan hold out against a Chinese invasion? Yes, a war game predicts

* China’s consumer inflation rises to highest level in two years

* Low water level in key rivers in Europe threaten to cripple trade

* US workers’ wages continue rising briskly, contributing to high US inflation

* US national average for gas falls below $4 a gallon for first time since March

* Rebound in value stocks continues to fade relative to growth shares:

The industrial sector may be a key factor for avoiding a recession in the US. “The industrial parts of the economy are certainly growing faster for us than the non-industrial parts right now,” says DG Macpherson, CEO of Grainger, which sells industrial parts. Melius Research analyst Scott Davis advises: “We strongly believe that the industrial economy will decouple from the consumer economy. There’s just too much pent-up demand for projects and megaprojects that are based more on secular changes than cyclical.”

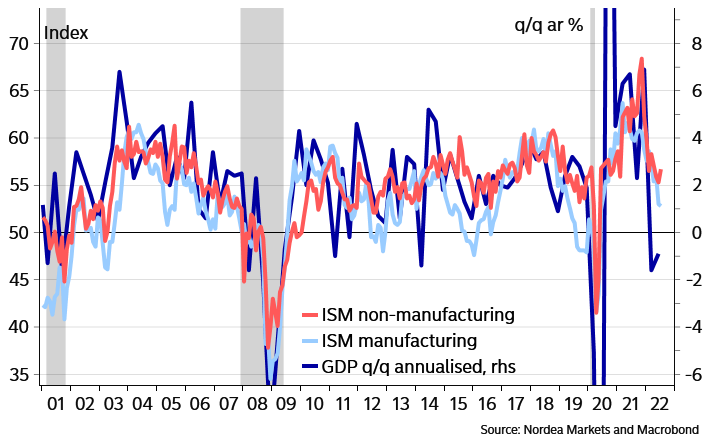

ISM Manufacturing and Services index suggest US economy is still growing, a view supported by the strong gain in payrolls in July. By contrast, GDP figures indicate the US is in a technical recession, analysts at Nordea advise. “US bond markets are acting like a US recession, and rate cuts are around the corner. We are not convinced at all and believe long-term bond yields will likely rise again after the summer, in part due to the Fed’s QT effect taking its full toll from September.”

adsf