* Fed leaves interest rates unchanged and downplays odds for a cut in March

* House passes $80 billion tax deal that now heads to Senate

* New warning for regional banks flashing via NY Community Bancorp downgrade

* China’s factory activity expanded for third-straight month in January

* Birthrates are still falling, raising challenges around the world

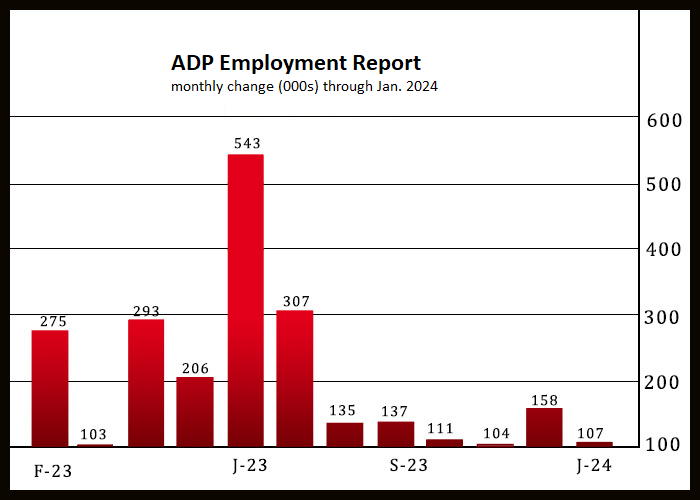

* US companies hire fewer workers than expected in January:

US 10-year Treasury yield fell below 4% on Wednesday for the first time in three weeks. The drop unfolded on a day when the Federal Reserve left interest rates unchanged but signaled that it would remain cautious on announcing the first rate cut. Markets had been expecting a cut in March, but the guesstimate has been moved forward to May at the earliest, according to Fed funds futures. “The good news is we can forget about any more tightening. The bad news it’s ‘when’, not ‘if’, they’re going to cut rates, and that ‘when’ has been pushed out to what had been the fringes of consensus,” says Art Hogan, chief market strategist at B. Riley Wealth.