* Federal Reserve expected to slow rate hiking today to 1/4 point

* Fed’s Powell may stress today that inflation fight is far from over

* China’s manufacturing contraction eases in January via PMI survey data

* Eurozone manufacturing contraction eases, suggesting worst has passed

* Eurozone inflation slows for third straight month in January

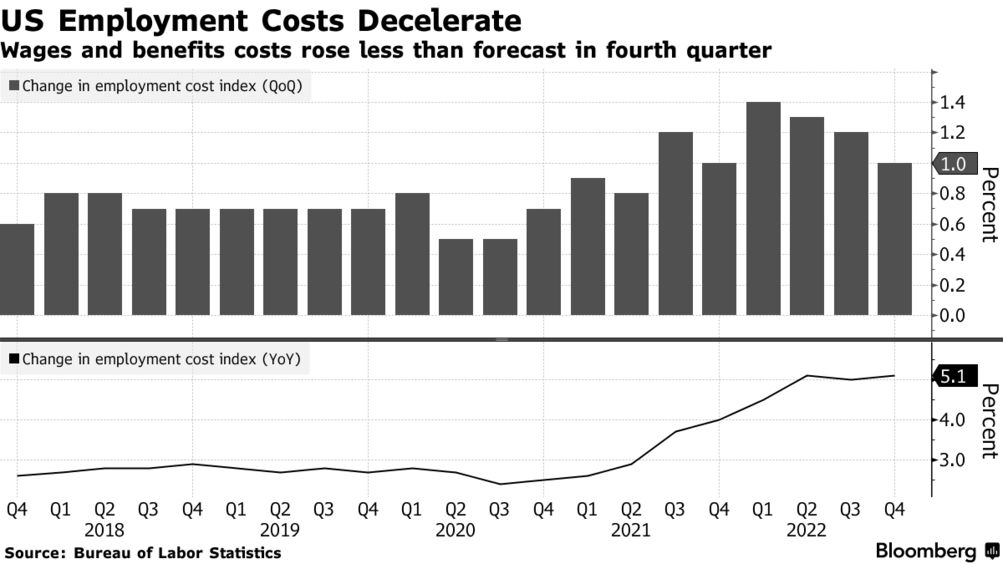

* Key employment cost index for US rose less than forecast in Q4

* US consumer confidence eased in January but above 2022’s low

* Chicago PMI falls more than forecast in January, indicating deeper contraction

* US home price growth cools gain in November, extending run of softer pricing:

Weighing the odds for stagflation vs. soft landing, economist Paul Krugman forecasts the latter is the more likely path ahead for the US economy. One bit of support is the slower pace of wage growth, he writes. The Employment Cost Index through 2022’s fourth quarter shows “wages and salaries rising at a 4 percent rate, only a bit higher than they were prepandemic. Diving into the details, things look a bit better, if anything. As Mike Konczal, a leading member of Team Soft Landing, put it: ‘The Fed has lost its excuse for a recession.'” Krugman concludes: “No doubt this debate will continue, as economic debates tend to. But I think we’re approaching the point at which Team Stagflation will have to do what Team Transitory did a while back: admit that they got it wrong, and try to figure out why.”