* Smaller rate hikes may start as early as Dec. 14 meeting, says Fed’s Powell

* House votes to block rail strike

* China signals slight easing of Covid policy after protests

* Pending home sales in US fall for fifth straight month in October

* Mortgage rates drop for third week but housing demand weakens further

* US job openings cooled in October

* Fed’s Beige Book: economic uncertainty rises as economic growth eases

* Q3 GDP growth is revised up to +2.9%

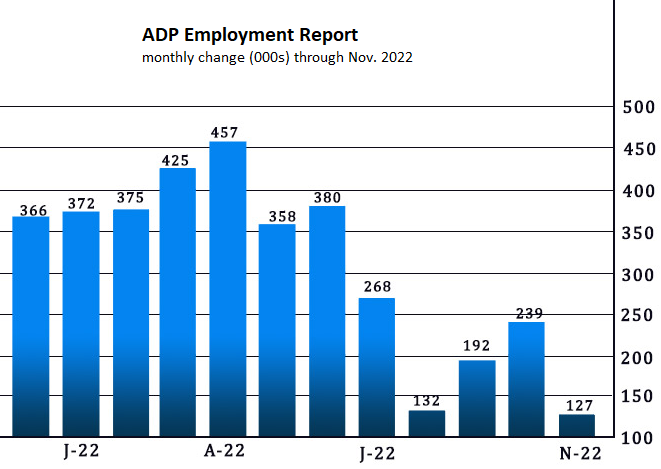

* US private employment growth slows sharply in November via ADP data:

Fed Chairman Powell says the biggest remaining challenge for taming inflation is workers’ wages. “To be clear, strong wage growth is a good thing,” he explains. “But for wage growth to be sustainable, it needs to be consistent with 2 percent inflation.” Speaking at the Brookings Institution on Wednesday he observes: “The labor market … shows only tentative signs of rebalancing, and wage growth remains well above levels that would be consistent with 2 percent inflation over time. Despite some promising developments, we have a long way to go in restoring price stability.”