* Pelosi starts Asia trip amid warnings not to visit Taiwan

* US deploys military assets near Taiwan as Pelosi considers visit

* First grain ship leaves Ukraine under Russia deal

* Factory outlook weakens in Asia and Europe

* China factory output unexpectedly contracted in July

* Emerging markets suffer record streak of withdrawals by foreign investors

* German retail sales fell nearly 10% in June–biggest annual decline since 1994

* US home price gains cooling rapidly, real estate data firm finds

* US consumer spending and personal income rose more than expected in June:

Sharp slide in inventories is a key factor in the weak US GDP report for Q2, observes Bob Dieli, economist at NoSpinForecast.com in a research report sent to clients: “The headline rate of GDP growth in the second quarter of 2022 was -0.9%. Much of that was due to the fact that inventories took 2.01% off the top line. Yeah, that’s almost an 8% swing in the headline rate, at the same time as we get about an 8% swing in the contribution from this one variable. A variable that we know has been profoundly affected by the supply chain problem and structural changes in the demand for many goods. This series is reported with a two month lag. And it is often subject to large revisions. How this series settles out will be a major determinant in how the National Bureau of Economic Research makes its determination where the cycle peak might be. They won’t be able to do that before the end of this calendar year.”

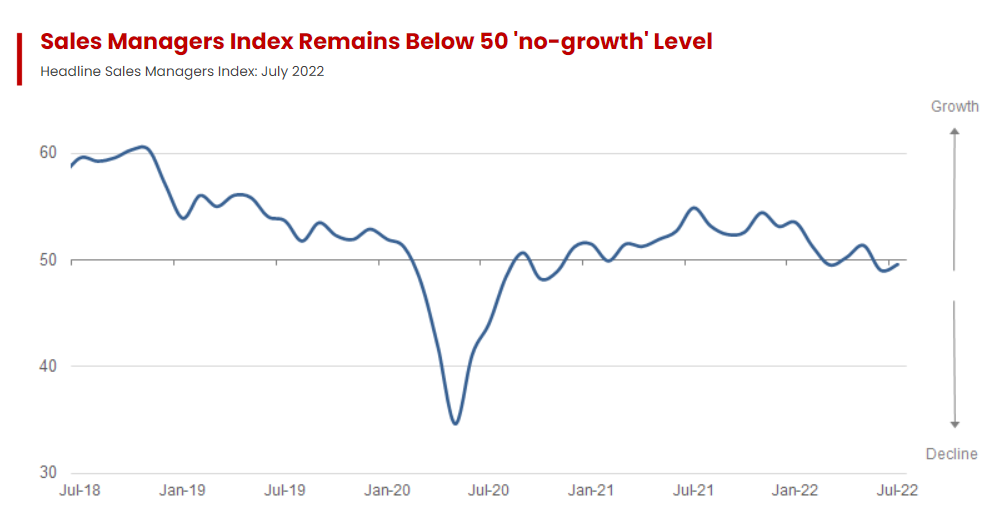

US sales managers anticipate a recession, according to the Sales Manager Index, a survey-based benchmark. “The US economy is very slowly tipping into recession according to the latest (July) data from the Sales Managers Monthly survey,” reports World Economics, a research shop. “Sales managers are very much the “front line” in terms of sensitivity to changing business conditions. Sensitive to contractual negotiations being deliberately slowed down.”