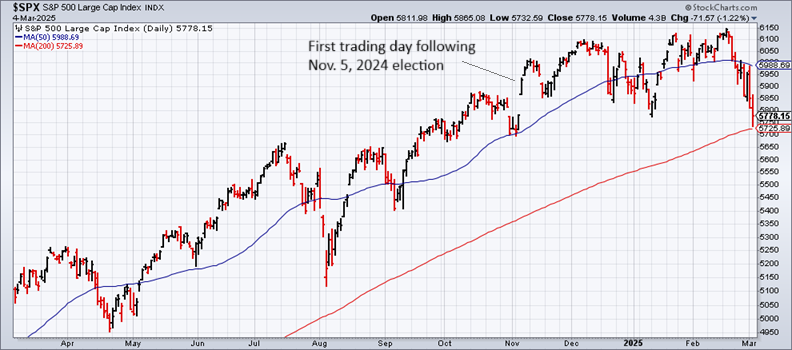

US stock market post-election gain evaporates amid concerns about negative economic effects from President Trump’s trade war. After yesterday’s drop in the S&P 500, equities are 2.5% below the Nov. 6, 2024 close, the first trading day following the election. Addressing Congress Tuesday night, Trump reaffirmed his committment to tariffs, admitting there will be “a little disturbance” and that there “may be a little bit of an adjustment period. You have to bear with me again and this will be even better,” he claimed.

President Donald Trump will “probably” announce tariff compromise deals with Canada and Mexico soon, says Commerce Secretary Howard Lutnick. Speaking with CNBC on Tuesday, he said: “Both the Mexicans and the Canadians are on the phone with me all day today, trying to show that they’ll do better. And the President is listening because, you know, he’s very, very fair and very reasonable. So I think he’s going to work something out with them.”

Consumers should expect higher prices on a range of goods as early as the end of this week due to Trump’s tariffs, business leaders warn. Target CEO Brian Cornell, for example, highlighted the risk of price increases after the Trump administration on Tuesday raised 25% duties on products from Canada and Mexico and lifting tariffs on China to 20%.

Staglation risk rises as concerns for higher inflation and slower growth resonate in the wake of Trump’s aggressive use of tariffs. “Directionally, it is stagflation,” predicts Mark Zandi, chief economist at Moody’s Analytics. “It’s higher inflation and weaker economic growth that is the result of policy — tariff policy and immigration policy.”

Trump wants Congress to kill the CHIPS and Science Act, which set aside $39 billion in grants for companies building new semiconductor manufacturing sites in the US. Most of that money has already been promised to chipmakers and was signed into contracts by the end of the Biden administration.

President Trump’s plan for a US strategic crypto reserve has created divisions within the cryptocurrency industry. Plans to buy cryptocurrencies beyond bitcoin, the leading coin, has spawned a rift within the industry. Billionaire bitcoin investor Tyler Winklevoss wrote: “I do not think they [several higher-risk coins] are suitable for a Strategic Reserve.” He added: “I have nothing against XRP, SOL, or ADA but I do not think they are suitable for a Strategic Reserve. Only one digital asset in the world right now meets the bar and that digital asset is bitcoin.”

US 10-year Treasury yield rose sharply, closing at 4.25% on Tuesday, after briefly falling to lowest level since October: