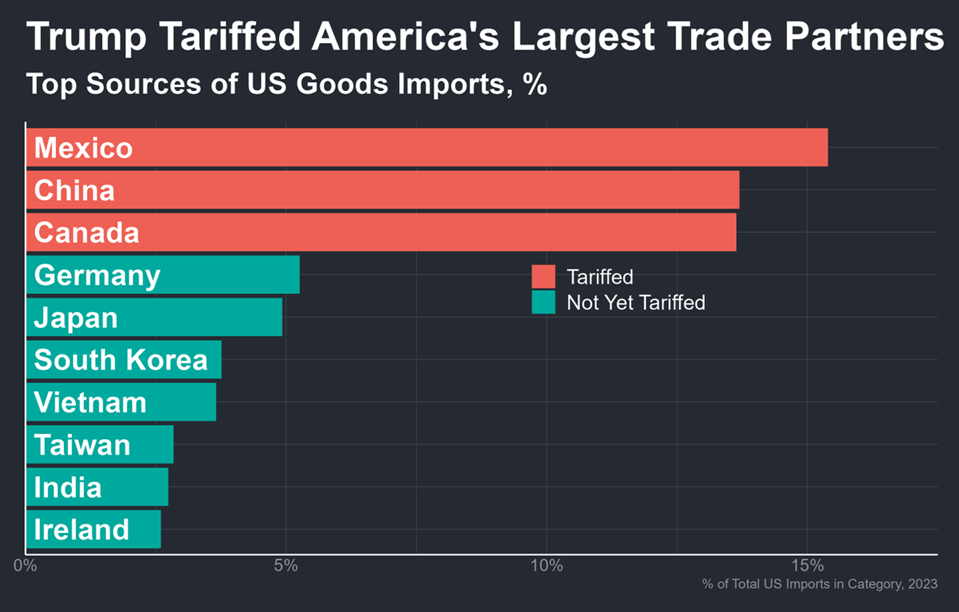

Canada and Mexico vow to retaliate after Trump imposes sweeping tariffs on both countries. The White House also announced higher tariffs on China. The tariffs are expected to lift inflation and slow growth in the US and elsewhere. “There was some optimism in the [US Treasury] market that [tariff threats] were just for negotiation, but the market may have underestimated the determination of the Trump administration,” says Jason Lui, head of Asia-Pacific equity and derivative strategy at BNP Paribas.

US consumer spending picked up in December, rising 0.7% vs. the previous month. The gain marks the second straight month of higher spending and is the strongest monthly gain since September.

A key measure of inflation targeted by the Federal Reserve strengthened in December. The personal-consumption-expenditures price index rose by 0.3% last month, compared with 0.1% in November. PCE inflation rose 2.6% increase for 2024, moderately above the Fed’s 2% inflation target.

Eurozone factory downturn eases at start of 2025, according to PMI survey data. The HCOB Eurozone Manufacturing PMI rose to 46.6 in January, an eight-month high, although it remains below the neutral 50 mark.

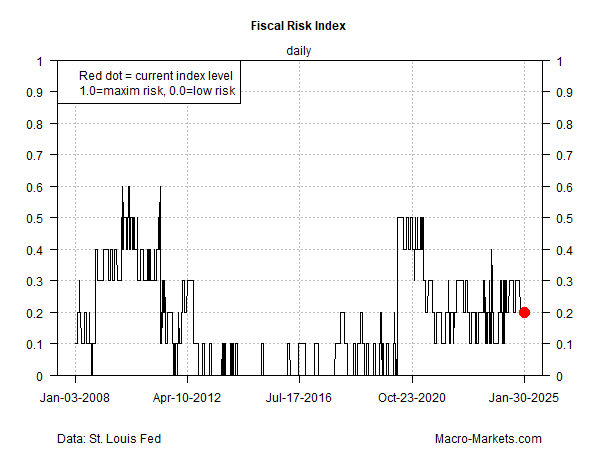

Two of ten indicators in the US Fiscal Risk Index are flashing warning signs, according to a research note from TMC Research, a division of The Milwaukee Company, a wealth manager. The price of gold and total US debt have risen sharply over the past year. The other eight indicators that comprise the index have yet to trigger warning signs. As a result, the US Fiscal Risk Index, which aggregates ten indicators to estimate the overall state of fiscal risk for the federal government, remains middling relative to recent history.