Bloomberg reports that “there are reasons to expect the current slowdown [in the global economy] will prove short-lived.” The same analysis may also apply for the US economy, according to The Capital Spectator’s business-cycle analytics.

Let’s start with considering the global macro trend. According to Bloomberg,

Bloomberg Economics, Deutsche Bank AG and Morgan Stanley are among those whose economists reckon the slide will bottom out in this quarter or next before an acceleration later in the year.

“Put the Federal Reserve pause, trade truce, and China stimulus together and we’re looking for a trough in the first quarter and very moderate pick up ahead,” said Tom Orlik, chief economist at Bloomberg Economics.

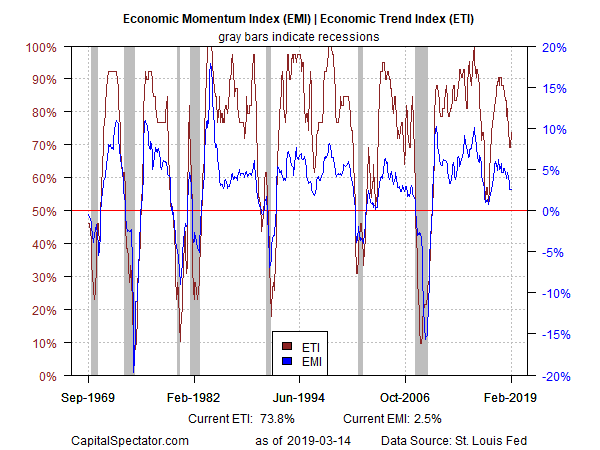

There are clues pointing to a similar transition for the US economy, based on a pair of benchmarks that track the country’s macro trend: the Economic Trend and Momentum indices (ETI and EMI, respectively), which are featured in The Capital Spectator’s monthly updates of the US business-cycle risk profiles (here’s last month’s update).

Recall that ETI and EMI offered early signs that US output was slowing, well before the crowd was focused on the deceleration. Last July, for example, the two benchmarks were sliding from previous peaks. Noting the downshift, we reported at the time that “near-term estimates of the US business cycle point to a mild deceleration in the trend.”

It’s easy to look back now and conclude that the slowdown was obvious. But in July 2018 the markets and the media were focused on the acceleration in growth in the first half of the year – an acceleration that peaked in the second-quarter, when GDP increased at a strong 4.2% pace (seasonally adjusted annual rate).

The subsequent slowdown that has cut GDP growth in each of last year’s Q3 and Q4 was anticipated by the downturn ETI and EMI, which have fallen sharply following peaks in early 2018. For example, ETI is currently at an estimated 71.4% for March vs. last July’s 83.3% and the 88.1% peak in 2018’s Q1.

The deceleration in the US macro trend, in other words, has been conspicuous for more than a year. The question is whether the deceleration has run its course or is poised to deteriorate further and raise the probability that a new recession is near?

Reviewing a wide spectrum of economic data, along with several business-cycle benchmarks, suggests that the slowdown may be stabilizing. ETI has rebounded slightly after dipping fractionally below 70% in December and January. The estimated print for March is currently 71.4% and the projections for April reflect another uptick to just under 74%.

As noted in this week’s edition of the US Business Cycle Risk Report: “It appears that growth will be slower but at a relatively stable trend. That’s subject to change, of course, but forward estimates of ETI and EMI through April indicate that the downshift in recent months is no longer deteriorating.”

Forecasting suffers all the usual caveats, of course, but the methodology for projecting ETI has proven to reliable. Why? Because ETI reflects 14 indicators that reflect a relatively comprehensive read of the US economy. Predicting the individual components is subject to a high degree of uncertainty, but aggregating each forecast into a composite projection for ETI reduces noise to a degree. In fact, that’s the message in the historical record for the ETI forecasts in recent years when compared with the final values that were subsequently published. (For a review of the forecasting record, see the last chart in this post.)

There are no guarantees, of course, but the numbers available at the moment offer a basis for thinking that the US economic slowdown may be giving way to a more stable environment. As always, the incoming data will confirm or deny the analysis. But indicators available in the here and now, and making some cautious near-term projections, implies that the recent deterioration in the US expansion is stabilizing.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Slowdown in Global Economy Could Be Short-Lived - TradingGods.net