Yesterday’s post reviewed the mixed signals for US recession risk based on CapitalSpectator.com’s proprietary business-cycle indexes. Today’s follow-up will take a deeper look at the data set in search of insight for deciding what comes next.

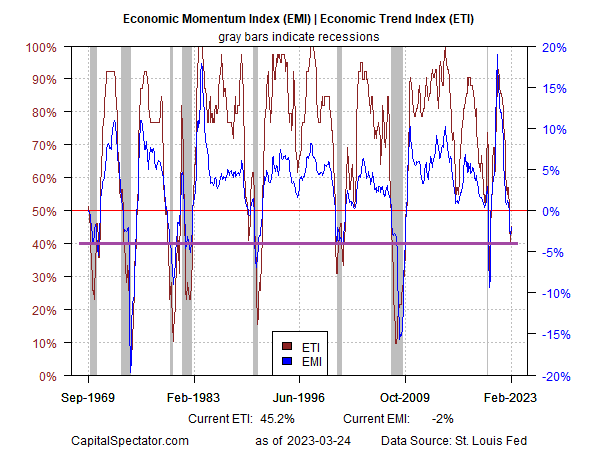

The set-up: the Economic Trend Index (ETI) and Economic Momentum Index have recently dropped below their tipping points (50% and 0%, respectively) — declines that suggest that an NBER-defined recession has started or is about to start. But this signal looks premature or wrong, based on various indicators that, in isolation, show the economy is still expanding. Notably, recent gains in the labor market and consumer spending continue to conflict with ETI and EMI. Meanwhile, nowcasts for first-quarter GDP suggest that recession risk is still low.

A possible explanation for why the recent slide in ETI and EMI values is that, in contrast with previous downturns, the decline remains relatively shallow. In previous downturns, ETI and EMI, after dropping below their respective tipping points, quickly reached lower troughs. By contrast, the declines this time have stalled so far.

That raises the question: Is the recent increase in recession risk a slower-moving threat this time, and one that will evolve and eventually strike after a longer gestation? Or has the recent weakness in economic activity been offset by an unusual confluence of forces that have effectively derailed what appeared to be an approaching recession?

For some context, consider how the various components in ETI and EMI are evolving, as shown in the table below. A possible sign that recession risk may deepen in the months ahead: the year-over-year change in initial jobless claims, a leading indicator for the labor market, is now issuing a warning after a long stretch of bullish behavior. That is, instead of falling, claims are now rising (note that for purposes of calculating ETI and EMI the claims data is inverted).

Real retail sales have been flirting with year-over-year declines in recent months, too. The implication: the relative strength in the consumer sector may be rolling over.

The March profile of indicators in the table above, which reflects a broad array of key drivers of US economic activity, is still largely unknown. Once all the data for this month are published in the weeks ahead, a clearer sign of how recession risk is evolving will emerge.

At this stage it’s fair to say that the economic trend, although still positive, remains vulnerable. The critical variables: the labor market and consumer spending. As new numbers for March are published, some of the mystery will fade as to what awaits for the economy in the second quarter and beyond.

This much is clear: the degree of red ink in the table above reminds that the so-called economic resilience remains precarious. The headwinds for the expansion, although significant, have yet to trigger an NBER-defined recession. But if the labor market and/or consumer spending stumble in March, the run of good luck may run out of road.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report