The global markets are predicting that the macro trend is turning ugly. In China, which is ground zero for the latest round of worries, it’s clear that growth is slowing. Given the size and influence of China’s economy, the fallout could be substantial. Does this mean that a new recession is destiny for the US? It’d be foolish to dismiss the threat that’s brewing. But it’s also clear that there’s still a positive tailwind blowing for the world’s largest economy through July. The key question: How will the trend compare in August? A compelling answer, one way or the other, will take several weeks at the earliest. Next week’s August report on nonfarm payrolls, for instance, will be a critical number for deciding if the trend is deteriorating. Meantime, let’s summarize what the numbers are telling us about the US macro trend to date.

The good news is that recession risk remained low through last month. As I discussed last week, the trend remained positive through July—a profile that will likely be reaffirmed in today’s update of the Chicago Fed National Activity Index. Big-picture metrics from other sources tell a similar story. The Philly Fed’s ADS Business Conditions Index, for example, is pointing to an upbeat trend, based on data through Aug. 20. One source of strength in the ADS benchmark: jobless claims, which remain close to a 15-year low through mid-August.

If there’s trouble brewing for the US, we may see early clues in the days ahead. We already know that manufacturing growth has been decelerating. The initial estimate for this month’s purchasing managers’ index (PMI) for the sector dipped to a 22-month low. Manufacturing activity overall is still positive, but “the strong dollar continued to put pressure on export sales and competitiveness, while heightened global economic uncertainty appeared to have dampened client spending both at home and abroad,” said Tim Moore, senior economist at Markit Economics. It’ll be useful to see how next week’s August update of the ISM Manufacturing Index compares.

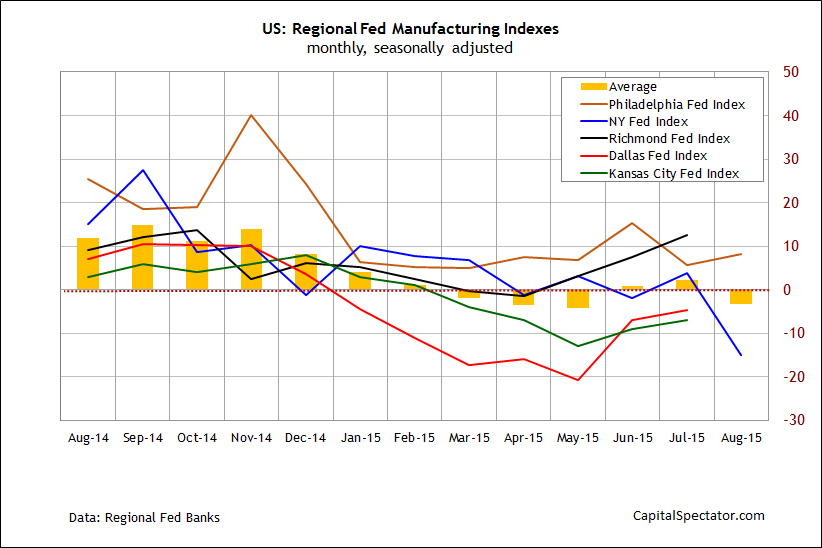

Meantime, keep an eye on how the remaining data points shape up for the regional manufacturing indexes from various Fed banks. We currently have August data for two of the five benchmarks and the results are mixed so far. The New York Fed data suffered an unusually sharp decline for this month’s reading, although that was partly offset by a modestly stronger reading from the Philly Fed for August. Nonetheless, the trend looks weak and so tomorrow’s numbers from the Richmond Fed deserve close attention.

Wednesday’s Tuesday’s initial estimate of activity in the services sector for August will be even more valuable for assessing the August profile. Based on the crowd’s estimate, growth is set to remain solid. Econoday.com’s consensus forecast sees the flash reading of the US Services PMI dipping slightly to 54.8 for August, but that’s still well above the neutral 50.0 mark that separates growth from contraction. In other words, the sector that represents the lion’s share of employment and economic activity in the US remains on track for a healthy if unspectacular expansion.

The main event for economic news this week is Thursday’s release of revised second-quarter GDP data. Economists are anticipating good news (according to Econoday.com): an upward revision in growth to 3.2% (seasonally adjusted annual rate), well above the 2.3% increase in the preliminary estimate.

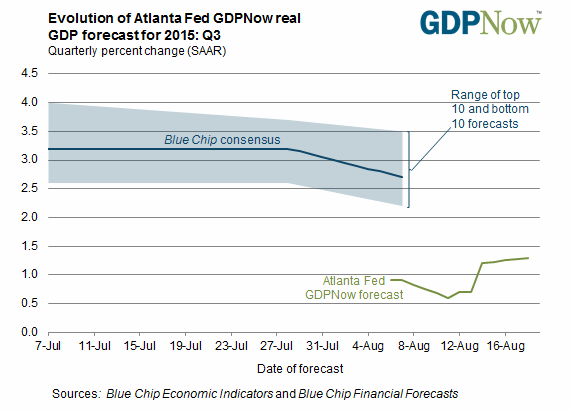

The key question is whether the growth in the recent past will survive in the months ahead? One widely watched estimate of the near-term outlook is telling us to manage expectations down. The Atlanta Fed’s GDPNow projection for Q3 growth is a relatively mild 1.3%, as of Aug. 18. But that’s up from the previous estimate of 0.7%. The current estimate is still pointing to a tepid pace, but the upward revision holds out the possibility that the final number may be higher once the final data is in.

The markets, however, are dispensing grim guesstimates of the future. Then again, the crowd’s real-time analysis of economic activity is hardly flawless. Granted, the macro numbers for China strongly hint at slower growth, and it’s hard to disagree at this point. Europe’s recovery is still intact, although growth overall remain sluggish. It doesn’t help to see that Now-casting.com’s latest estimate for Q3 GDP growth in the Eurozone is sliding, dipping to 0.3% in last week’s update—half as much vs. the early July projection.

As for the US, the expansion rolls on. The August macro profile will likely remain positive, sticking close to what we saw for July. The markets, however, are telling us that the headwinds are due to strengthen for the US. There’s not much support for that view in terms of the hard numbers today. But that’s due to change, or so Mr. Market advises.

Pingback: Monday Morning Links | timiacono.com