Foreign equities have had a strong run over the past week (5 trading days), with most of the major regional markets besting US stocks, based on a set of ETFs in unhedged US-dollar terms. Is this a sign that the ex-US equity space is due to outperform? Maybe, although there’s still plenty of ground to cover to catch up with the long-dominant American stock market. There’s also the macro factor lurking–slower global growth.

For the moment, however, the trailing 5-day horse race looks promising for ex-US equities. Save for the Middle East, based on the Market Vectors Gulf States ETF (MES), the world’s major regional slices of foreign stocks outperformed US equities via the SPDR S&P 500 ETF (SPY). Latin America has been especially bubbly over the past week. The iShares Latin America 40 ETF (ILF) popped a bit more than 8% over the trailing 5-day period—roughly twice as much as SPY’s gain over the same period.

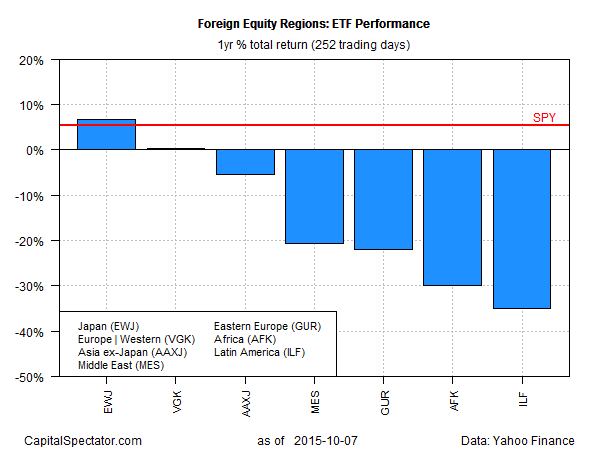

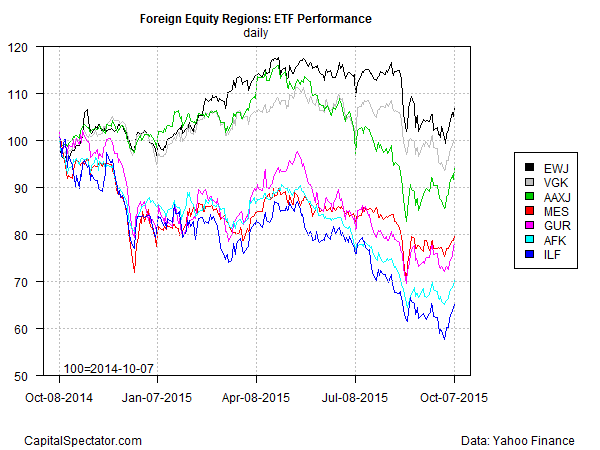

But if foreign stocks are headed for a run of superior performance over US equities, the changing of the guard isn’t obvious in trailing one-year returns (252 trading days). By this performance window SPY is still in the lead over most of the world’s equity regions. Only the iShares MSCI Japan (EWJ) has a modestly stronger one-year total return. EWJ is ahead by 6.7% over the past year vs. SPY’s 5.3% total return.

In fact, when we compare all the world’s major equity regions ex-US it’s even clearer that Japan remains the foreign leader by far. Western European stocks are in second place, albeit with a virtually flat return of just 0.4% for the past year, based on the Vanguard FTSE Europe ETF (VGK).

One of the headwinds for equities ex-US has been the bull market in the US dollar, which reduces any offshore gains (or exacerbates losses) after translating results from foreign currencies into greenbacks. The rising dollar has been particularly troublesome for emerging markets, in part because of their relatively high reliance on paying for imports with dollar reserves.

Charles Robertson, global chief economist at Renaissance Capital, advised in a recent note to clients that “we expect external debt defaults to hit EM financials and corporates and higher import prices will feed into weaker domestic demand and hurt GDP,” the FT reports.

Foreign developed markets aren’t as vulnerable to a strong dollar, which suggests that any revival in foreign stocks vs. US equities will be an uneven affair.

But maybe there’s some currency relief on the way. Although the dollar has rallied sharply since mid-2014, the bull market in the buck has stalled since this past spring. The PowerShares DB US Dollar Bullish ETF (UUP) has been stuck in a trading range for the past six months. Is that a signal for thinking that the dollar’s up trend is over?

Much depends on the Federal Reserve. If the central bank delays rate hikes deep into next year, as some analysts are now predicting, the dollar may stay flat or even weaken. If so, the latest tailwind in foreign equities may continue blowing.

But there’s another caveat for equities the world over: the prospect of slower growth. As I noted yesterday, macro momentum is slowing in the global economy overall. If the deceleration continues, the softer trend will weigh on equity prices everywhere. In that case, a weaker dollar isn’t going to offer much assistance in boosting the outlook for foreign equities.