The crowd’s expecting a rate hike when the Federal Reserve publishes its policy statement today at 2:00 pm eastern. Fed fund futures and the 2-year Treasury yield, for example, are telling us that today’s the day when the central bank begins raising its target rate for the first time in nine years.

Indeed, Fed funds futures are currently pricing in an 81% probability of a hike that pushes the target rate above the current zero-to-0.25% range, according to the CME Group.

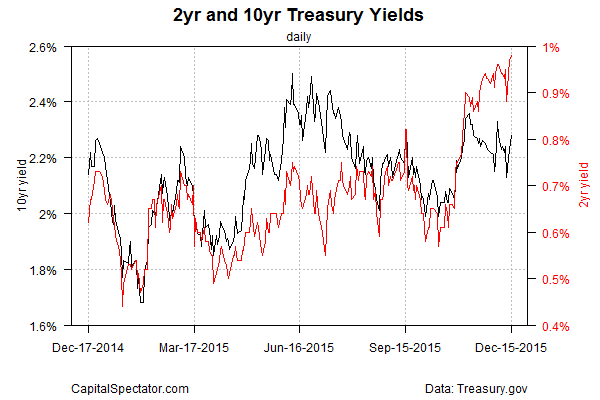

Meanwhile, the 2-year Treasury yield—said to be the most sensitive spot on the yield curve for rate expectations—ticked higher yesterday (Dec. 15), reaching 0.98%–a five-and-a-half-year peak, based on Treasury.gov data. The benchmark 10-year yield also increased, but remains well below its peak in recent years.

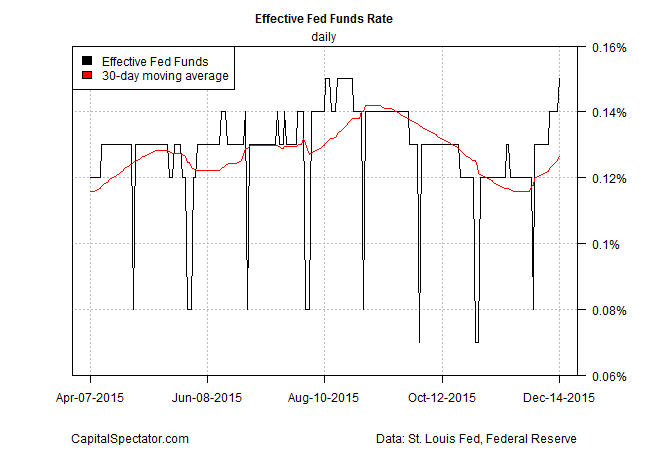

The effective Fed funds rate (EFF) made a sharp turn higher at the start of this week. EFF ticked up to 0.15% on Monday, Dec. 14—the highest since September. Yet the current target policy rate is zero-to-0.25% while EFF is below that rate. Is the mismatch a sign that a rate hike is less likely than widely believed? We’ll have the answer in a few hours.

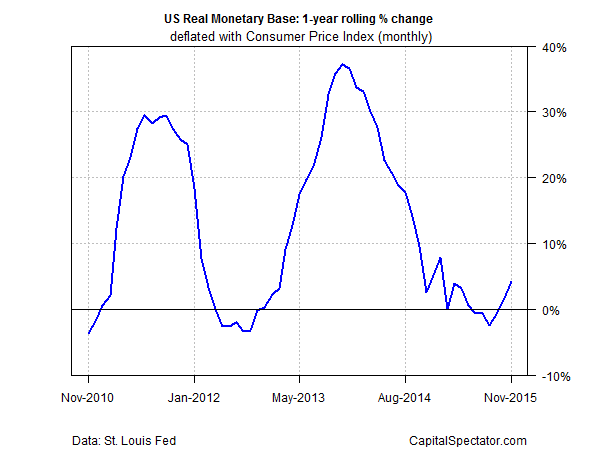

Finally, the real (inflation-adjusted) monetary base has made a U-turn lately, rising 4.1% in November vs. the year-earlier level. That’s a modest gain, but it’s the fastest advance since January. Is the modestly higher level of liquidity another sign that monetary policy may remain looser than expected?

Not necessarily, advised Tim Duy, an economics professor at the University of Oregon and author of the widely read Tim Duy’s Fed Watch blog. “The final days of the zero interest-rate policy known as ZIRP are upon us; the end is here,” he wrote yesterday.

The only question is whether Janet Yellen and company agree. Stay tuned….