Energy was the hot sector last year, but so far in 2023 it looks like a shift in leadership could be unfolding, based on a set of sector ETFs through the close of trading on Jan. 25.

The current leader: Communication Services Select Sector SPDR Fund (XLC), which is up nearly 13% year to date. It’s still early in the year, of course, and so a few weeks is hardly definitive. But the wide gap in XLC vs. last year’s big winner – energy (XLE) – is striking and begs the question: Is a change in sector leadership brewing?

Keep in mind that the current definition of communications includes firms that also fall under the heading of Big Tech – names such as Meta and Alphabet. But while XLC is in some respects a tech fund masquerading as a communications ETF, it’s notable that the fund is still outperforming the standard tech sector lineup via XLK year to date by a moderate degree. That appears to be a function of a somewhat different mix of tech and communications services stocks in XLC.

Perhaps it’s fair to label XLC as a variation on tech. However you define it, it’s a winning mix so far in 2023 and casts a striking contrast with the relatively weak gain so far this year for 2022’s big winner: energy (XLE), which is up a comparatively light 3.2%, which is comfortably below the broad market’s 4.7% year-to-date gain via SPDR S&P 500 (SPY).

Although most of the US equity sectors are higher so far in 2023, three relatively defensive slices of the market are nursing modest losses. The biggest setback so far this year: utilities (XLU), which is down 2.6%.

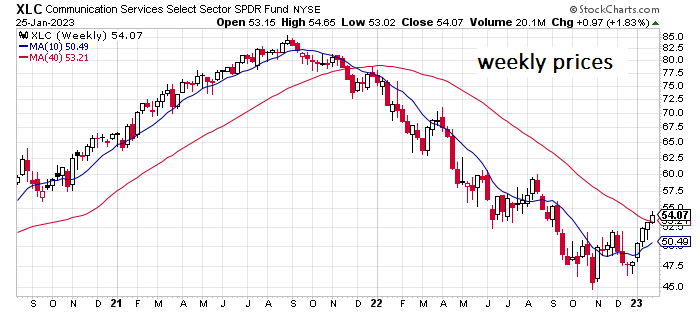

Meanwhile, looking at trending behavior for the sector ETFs overall suggests that bullish momentum is bubbling. After a rough 2022, upside momentum has recovered sharply, based on a set of moving averages (see chart below).

The question is whether the bounce is a bear-market rally or the start of new bull run? Deciding which way the wind is blowing (and will continue to blow) may depend on how the broad market fares in the next few weeks. In particular, it remains to be seen if the S&P 500 (SPY) can break free of the downside trend that’s prevailed for much of the past year. At the moment, it’s fair to say that the bears still have the upper hand. Let’s see if the trading sessions ahead suggest otherwise.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno