Equal weighting asset allocation doesn’t look encouraging as a portfolio-design tool, based on last week’s preliminary analysis. Can we salvage equal weighting by expanding the opportunity set with a more granular mix of funds? In a word, no. As we’ll see, equal weighting across asset classes via a wider spectrum of funds doesn’t lead us to a different conclusion.

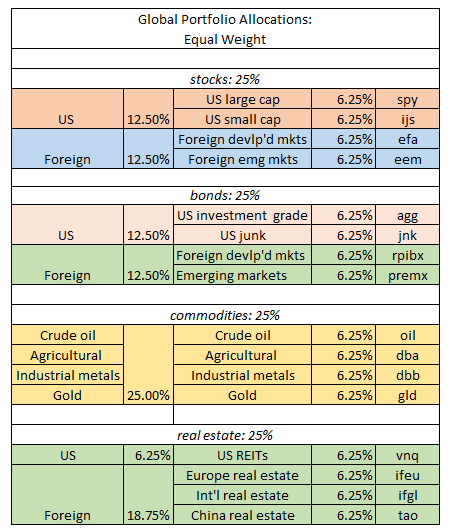

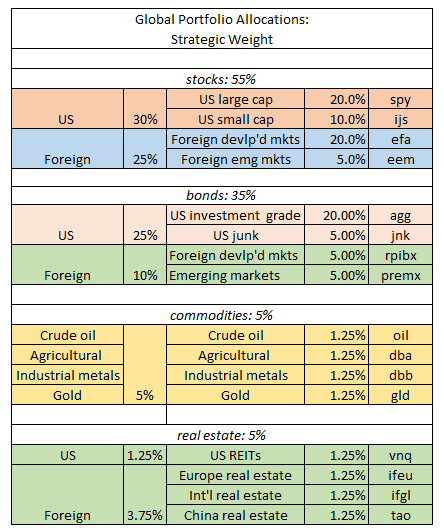

As a test, let’s build a portfolio that holds equal weights in asset classes and maintains equilibrium across all the funds—16 in total for this test. (Note: because one fund in the test has a shorter track record than the rest of the field, the sample period this time is shorter by one year vs. the previous post, i.e., the new start date is Dec. 31, 2007.)

The benchmark for comparison is a strategic-weighted portfolio, which is inspired by a simple 60%/40% global stock bond allocation and taking five percentage points from each side and reallocating to 5% real estate and 5% commodities.

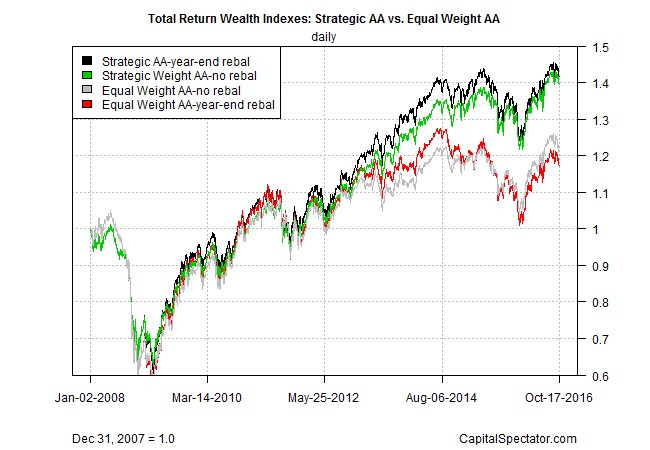

Once again, the analysis reviews unrebalanced and year-end rebalanced (back to the respective target weights) portfolios. The results, however, are in line with the output with the previous analysis. In sum, equal weight trails strategic weight by a substantial degree, for both rebalanced and unrebalanced versions.

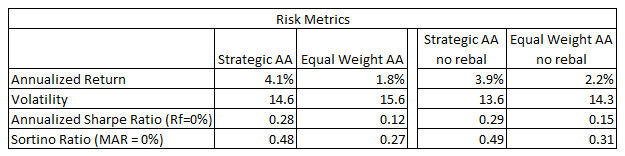

The difference between the two portfolio designs is also clear when we review return and risk numbers:

The bottom line: equal weighting delivers conspicuously lower performance and higher risk. Why? One possibility is that the relatively short sample period (2007-2016) is misleading, which suggests that testing over a longer time frame may dispense a different result. It’s interesting to note that the strategies deliver comparable results until 2013, when the strategic-weighted portfolio pulls ahead.

Another theory is that the encouraging track record for equal weighting when building stock portfolios doesn’t translate to asset allocation. The reason: equal weighting in equities enhances the small-cap and value effects–factors that tend to generate higher performance through time. Equal weighting in equities succeeds by boosting exposure to these sources of higher return. But the asset allocation framework in the test above doesn’t offer a comparable opportunity across asset classes, at least not for the sample period tested. As a result, equal weighting stumbles because it’s holding a wider set of asset classes, some of which suffer lower performance and higher risk for the 2007-2016 period under scrutiny.

The results above are only a rough approximation of what equal weighting can (or can’t) deliver in an asset allocation framework. But based on this initial review, the results don’t look encouraging for expecting that we’ll find a different result with a deeper round of testing.

Pingback: Quantocracy's Daily Wrap for 10/18/2016 | Quantocracy

EW should, in some cases, be considered a strategy, which overweights based upon constituent count. Judging EW’s merits is akin to performance attribution of the overweights relative to other techniques such as mkt cap weighting.