Judging by the comments of several high-profile perma bears, the US economy should be in recession any day now. But the Treasury market seems to be reading a different script.

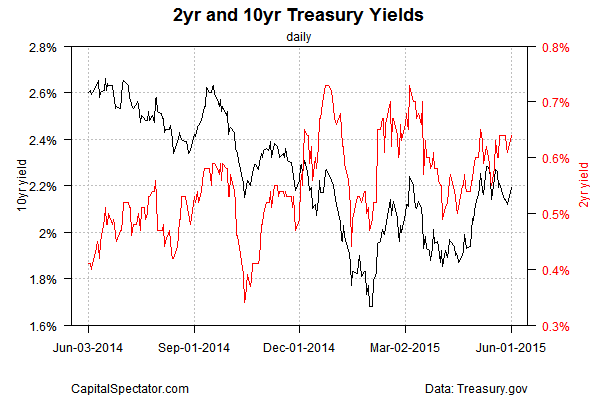

To be fair, yields aren’t really rising when we look across the sweep of the last several months. But the key issue at the moment: rates aren’t falling either. That raises the question: If the US economy is slipping over to the dark side, would there be a clear (or clearer) sign in the benchmark 10-year yield?

Maybe not. The Fed’s monetary manipulations may be suppressing robust signals that would otherwise be percolating from the Treasury market in “normal” times. But let’s go out on a limb and consider recent market action at face value, which suggests that the crowd isn’t particularly eager to price in a new recession. A burst of robust growth isn’t in the cards either. In any case, the 10-year yield ticked up to 2.19% yesterday (June 1), based on Treasury.gov’s constant maturity data. That’s an unremarkable level, except for the fact that it’s close to the highest levels so far this year.

The two-year yield—said to be the most sensitive spot on the yield curve for rate expectations—is also relatively firm of late. Yesterday’s 0.26% is close to the highest rate since mid-March.

But maybe we’re splitting hairs and so it’s reasonable to argue that the Treasury market is treading water, perhaps waiting for the next shoe to drop… or not. This Friday’s payrolls report for May may turn out to be critical, for good or ill. Economists are looking for another solid rise above the 200,000-mark for total non-farm payrolls–225,000, according to Briefing.com’s consensus forecast. If the actual number sticks close to that prediction, the chatter about recession risk will fade. A downside surprise on Friday, by contrast, will strike some (many?) as a confirming signal that the jig is up.

As for the Treasury market, the fixed-income crew appears to be hedging its bets and taking the middle road… for now.

By some accounts, a new recession is fate. Maybe, but several econometric business-cycle models suggest otherwise. The Philly Fed’s ADS Index, for instance, isn’t flashing a warning sign for the economy, based on data through June 1. Growth is certainly sluggish at the moment, but this real-time benchmark’s latest number implies that the threat of a new contraction is low.

“The conditions for beginning the tightening of monetary policy have not yet been met,” Boston Fed President Eric Rosengren said yesterday. Fair enough, although the Treasury market to date hasn’t been eager to cut rates either.

Pingback: 06/02/15 - Tuesday Interest-ing Reads -Compound Interest Rocks

Pingback: Yield on 10-Year Treasury Increases Slightly