Will last week’s news of substantially stronger-than-expected growth for US economic output in 2023’s fourth quarter extend into this year’s Q1? It’s too soon to make high-confidence estimates, but CapitalSpectator.com’s initial median nowcast (based on several independent estimates) for this year’s first quarter suggests the expansion will continue to slow relative to the previous high point in last year’s red-hot Q3.

It’s still early in the current quarter and so there’s plenty of guesswork lurking for the immediate future. That caveat aside, our opening median nowcast indicates a 1.5% rise in Q1 GDP (seasonally adjusted annual rate). That’s a hefty downshift from Q4’s robust 3.3% rise, a gain that surprised most analysts, including CapitalSpectator.com’s final estimate ahead of the government’s report last week.

The haircut for the Q1 estimate implies that last year’s strong run of economic activity faces stronger headwinds this year. Nonetheless, a 1.5% rise in Q1 GDP is still strong enough to keep recession risk relatively low.

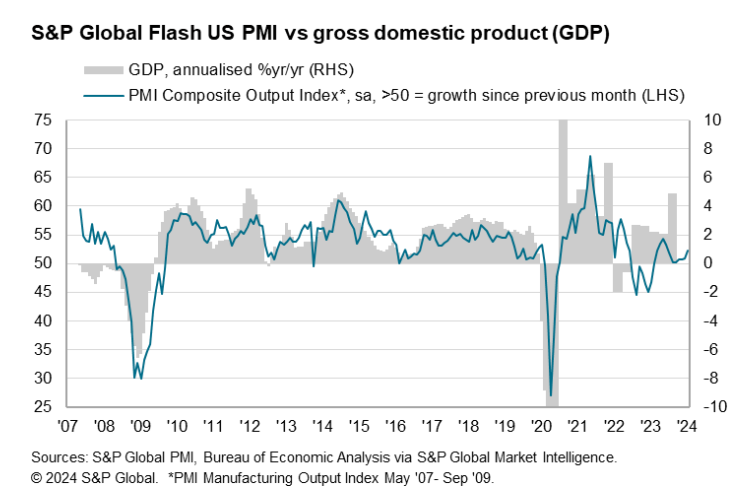

Meanwhile, survey data for January paints an upbeat profile, based on this month’s US PMI Composite Output Index, a proxy for GDP. This benchmark rose to 52.3 in the opening month of the year, marking a seven-month high. A reading above the neutral 50 mark equates with growth, moderately so in this case.

The firmer PMI print reflects “an encouraging start to the year,” says Chris Williamson, chief business economist at S&P Global Market Intelligence, which publishes the data. “Output measured across both goods and services rose in January at the fastest rate since last June, growth momentum having stepped up a gear on the back of improved demand conditions.”

Another bright spot that could provide crucial support to economic activity in the months ahead is the recovering mood in the consumer sector. Yesterday’s ongoing recovery in the Consumer Confidence Index for January lifted this measure to a two-year high.

“January’s increase in consumer confidence likely reflected slower inflation, anticipation of lower interest rates ahead, and generally favorable employment conditions as companies continue to hoard labor,” says Dana Peterson, chief economist at The Conference Board.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report