Today’s the day for the Brexit vote. The UK goes to the polls on Thursday to decide if Britain will remain in the European Union. Most polls shows that a “virtual dead heat”, The Wall Street Journal advises.

Sales of existing US homes rose to a nine-year high in May, according to the National Association of Realtors (NAR). Transactions increased 1.8% last month to a seasonally adjusted 5.53 million. “This spring’s sustained period of ultra-low mortgage rates has certainly been a worthy incentive to buy a home, but the primary driver in the increase in sales is more homeowners realizing the equity they’ve accumulated in recent years and finally deciding to trade-up or downsize,” says Lawrence Yun, NAR chief economist. Millan Mulraine, deputy chief economist at TD Securities, tells Reuters that “the housing market recovery is truly back on track …, which should reinforce confidence that the economic recovery is moving in the right direction.”

US home prices rose 0.2% in April vs. the previous month the Federal Housing Finance Agency (FHFA) reports. For the year, prices advanced 5.9% through April, modestly below the 6.2% year-over-year gain through March.

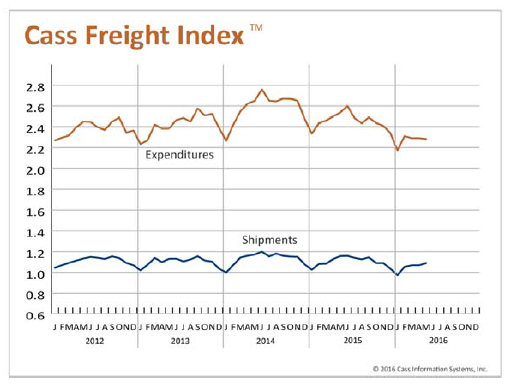

North American freight shipments continued to climb in May, based on data published by Cass Information Systems. The firm’s advises that shipments rose 1.3% last month, but were down 5.8% vs. the year-ago level. Meanwhile, expenditures for freight slumped 0.4% in May and tumbled 10.1% on a year-over-year basis. “The current economic outlook is volatile, which has led to slow uneven growth,” Cass said.

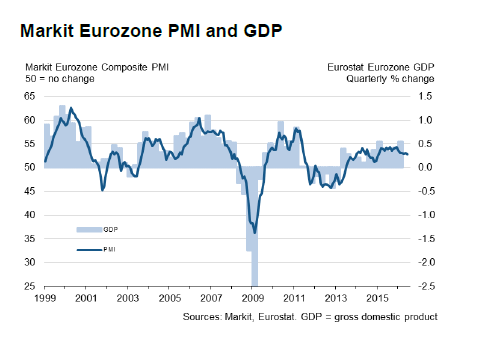

Eurozone growth eased to its weakest pace in nearly 1-1/2 years, according to survey data for June via Markit Economics. The Eurozone Composite PMI dipped to a 17-month low of 52.8 in this month’s flash reading—down slightly from 53.1 in May. Although that’s still above the neutral 50 mark that separates growth from contraction, today’s update suggests that Europe’s sluggish recover is losing momentum. “June’s survey data point to steady though disappointingly lackluster economic growth,” says Chris Williamson, Markit’s chief economist. “Rising political uncertainty appears to have caused the pace of expansion to weaken slightly and business confidence about the outlook to deteriorate.” Today’s numbers imply that Eurozone growth will weaken to 0.3% in the second quarter from 0.6% in Q1, notes Williamson.