US consumer spending rose 1% in April–the strongest monthly gain in seven years, the Bureau of Economic Analysis reports. “The solid rebound in spending will likely be interpreted at the Fed as a key indication that the economic recovery has regained its footing after the missteps over the past three quarters,” says Millan Mulraine, deputy chief macro US strategist at TD Securities.

Consumer confidence in May, however, slipped to the lowest reading since last November, the Conference Board advises in its monthly survey report on Tuesday. “Expectations declined further, as consumers remain cautious about the outlook for business and labor market conditions. Thus, they continue to expect little change in economic activity in the months ahead.” The weaker data contrasts with last week’s firmer data for the competing consumer sentiment figures in May via University of Michigan’s survey figures.

The Atlanta Fed’s revised estimate for US GDP growth in Q2 remained unchanged at 2.9% in Tuesday’s update of the bank’s GDPNow report. The projection continues to reflect a solid rebound after the tepid 0.8% advance in Q1.

Texas factory activity declined in May after two months of increases, the Dallas Fed’s survey shows. The production index, a key measure of state manufacturing conditions, fell from 5.8 to -13.1, hitting its lowest reading in a year.

The Chicago PMI eased back into contractionary territory in May, dipping to a three-month low.

Housing price increases in the US remained firm in March, according to the S&P/Case-Shiller 20-City Composite Home Price Index. The benchmark increased 5.4% for the year through the end of the first quarter. “The economy is supporting the price increases with improving labor markets, falling unemployment rates and extremely low mortgage rates,” says David Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices.

The volume of world trade declined 0.5% in March 2016 after rising 1.3% in February, according to CPB Netherlands Bureau for Economic Policy Analysis.

Eurozone manufacturing activity barely increased in May via revised survey data published by Markit Economics today. “The disappointing performance of manufacturing adds to suspicions that the pace of Eurozone economic growth in the second quarter has cooled after a surprisingly brisk start to the year,” says Chris Williamson, chief economist at Markit.

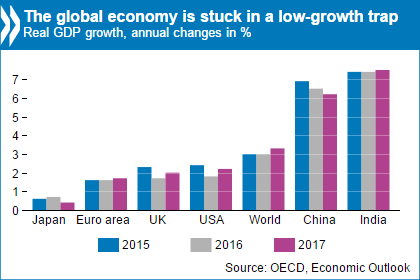

The Organization for Economic Cooperation and Development (OECD) warns that a “low-growth trap” will persist if governments around the world don’t take a stronger stand and embrace expansionary policies. “The need is urgent,” said OECD chief economist Catherine Mann. “The longer the global economy remains in the low-growth trap, the more difficult it will be to break the negative feedback loops.”