Recent updates continue to suggest that the recent surge in US inflation is cresting. The mystery is how long the peaking process will last.

In a sign of the fluid outlook for estimating the persistence of “transitory” inflation, two Fed officials this week said that the higher pricing pressure could endure for longer than previously expected. Federal Reserve Chairman Jerome Powell offered similar comments in yesterday’s press conference.

Let’s start with Atlanta Fed President Raphael Bostic and Fed Governor Michelle Bowman, who are cautious on anticipating a quick and sharp decline in inflationary pressures. “Temporary is going to be a little longer than we expected initially … Rather than it being two to three months it may be six to nine months,” he predicted this week in an interview with NPR.

Bowman, speaking at a conference, said higher prices are due congested supply chains and rising demand.

Bostic explained that “given the upside surprise in recent data points I pulled forward my projection.” As a result, he’s in the camp of policymakers who think the central bank needs to begin raising interest rates at some point in 2022.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

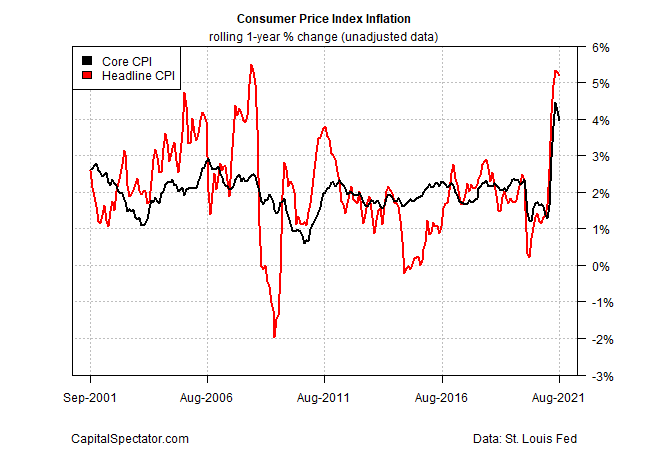

Note, too, that the Federal Reserve yesterday raised its inflation forecast for 2021 to 4.2% at the headline level – up from June’s 3.4% estimate. The central bank also lifted its core inflation outlook for this year to 3.7% from 3.0% previously. On both counts, the forecasts are far above the Fed’s 2% inflation target.

Pricing pressure is expected to ease substantially in 2022, the Fed projections show, dropping to just above the 2% target.

Meanwhile, actual consumer price inflation reported by the government showed signs of peaking in the August numbers. The one-year trend for headline CPI eased to 5.3% and core CPI dipped to 4.0%.

Peeking into the near-term future via CapitalSpectator.com’s Inflation Trend Index (ITI) supports the view that pricing pressure is peaking. (ITI seeks to provide a degree of forward guidance on the directional bias of pricing activity in real time, but is not intended to be a proxy for estimating the government’s inflation indexes.) New data published since the previous ITI update (Sep. 15) still point to a mostly steady inflation trend in September that’s on track to ease in October (red line in chart below).

For a clearer review of the evolution of ITI in recent history, here’s how monthly changes in the index compare. In contrast with the previous estimate of no change for September, today’s estimate indicates a fractional increase in ITI for this month over August.

Overall, inflation still appears to be peaking, but there’s more uncertainty about how long the elevated levels will last. Fed Chairman Jerome Powell admitted as much yesterday, observing at a press conference that bottlenecks in supply chains and shortages in supplies are extending the peaking process.

“These bottleneck effects have been larger and longer-lasting than anticipated,” he said. “While these supply effects are prominent for now, they will abate. And as they do, inflation is expected to drop back toward our longer-run goal.”

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno