Buy on the rumor, sell on the news. That ancient bit of trading advice seems to describe last week’s data for Treasury yields. In the days leading up to Friday’s report on payrolls for April, the benchmark 10-year yield increased to a new year-to-date high on Wednesday, only to slump when the better-than-expected jobs report arrived. The conventional wisdom interprets April’s solid job gains as a convincing signal that the economy is rebounding after a weak first quarter. In turn, the upbeat outlook has renewed forecasts that the Fed will lift interest rates later this year. Maybe, although the Treasury market seems to be having second thoughts… again.

The 10-year yield closed on Friday (May 8) at 2.16%, down from Wednesday’s 2.25%–the highest since last December, based on Treasury.gov’s constant maturity data. But if the rise through last Wednesday was a sign of the market’s growing confidence in a Q2 revival, the conviction started to crack a bit on Thursday and Friday. A similar reversal describes trading action for the 2-year Treasury, which is widely considered as the most yield curve’s most sensitive spot for rate expectations. In fact, the 2-year yield remains well below its recent peak. If the crowd is confident that a rate hike is again a high-probability event for later this year, it’s not obvious in the 2-year yield, which hasn’t changed much from its mid-March levels.

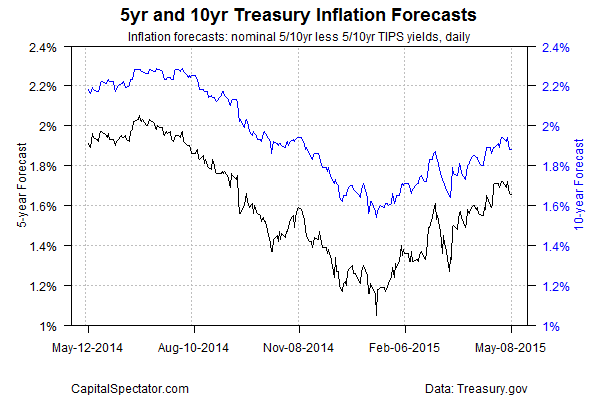

The Treasury market’s implied inflation forecasts also made mild U-turns late last week. The implied inflation rate via 10-year Treasuries (based on the yield spread for the nominal less inflation-indexed Notes) dipped to 1.88% on Friday, down from as high as 1.94% earlier in the week.

Several days of trading hardly constitutes a trend and so we should be careful in reading too much into last week’s incremental yield reversal. Perhaps the latest dip is just a round of consolidating as the market prepares to raise rates in the coming weeks in anticipation of accelerating growth in the second quarter.

But if the macro numbers are destined for a revival after the virtually flat change in Q1 GDP, the bullish clues aren’t obvious in the Atlanta Fed’s GDPNow forecast for the second quarter. The bank’s current nowcast is a thin +0.8% for Q2. That’s up slightly from Q1’s dismal 0.2% rise, but just barely. That’s in contrast to 3%-plus Q2 estimates via the Blue Chip consensus numbers based on economists’ views.

Then again, it’s still early and most of the Q2 data is ahead of us. This week’s opportunity for an attitude adjustment includes Wednesday’s update on retail sales for April. The evidence of a Q2 revival, however, may be in short supply: Econoday.com’s consensus forecast sees headline consumption advancing by just 0.2% in April for the monthly comparison, sharply below March’s 0.9% advance. The lesser pace may be nothing more than payback after March’s surprisingly strong increase. Nonetheless, if the forecast holds up, the news will provide support for the Treasury market’s wait-and-see bias.