Bull markets have been known to climb a wall of worry. But when does a rising supply of unease become too much to handle?

The answer may be forthcoming as investors digest an expanding front of worrisome developments in the political realm. Let’s start with the US, where President Trump has delivered a daily barrage of politically contentious tweets, statements, and executive orders since his inauguration last month. From threatening a trade war to “demoralizing” attacks on the judiciary, America’s boisterous new leader has been ripping up the script left and right. In the wake of this tsunami of words and ideas investors are left to wonder what it all means for the US economy and the state of geopolitical affairs.

Ian Bremmer, who heads up the Eurasia Group, a consultancy, describes the policy changes unfolding under the Trump administration as the most significant for political risk in 2017 since World War II.

It’s a geopolitical recession; it’s the beginning of a long cycle. We are now at the end of the Pax Americana. For the last decades, if you’re thinking about the global marketplace, globalization and Americanization have been the same thing. Globalization is continuing. Americanization is not. We’re making it very clear that we no longer want to be the cheerleader of global values or the architect of global trade or the world’s sheriff.

Regardless of whether you support the change or not, there will be repercussions. Trump supporters argue that when the dust clear the US will be in a stronger position economically and geopolitically because of the policy changes underway. Skeptics take the opposite view.

Mr. Market, one can argue, remains optimistic. The S&P 500 Index, after surging in the wake of Trump’s election victory in November, continues to hold on to the gains and remains close to an all-time high. One might wonder why equities remain elevated amid so much turmoil and uncertainty that’s directly linked to the White House? The potential for stronger economic growth seems to be the main answer, perhaps the only answer.

Some economists predict that Trump’s plans to cut taxes and regulation, along with new infrastructure spending, will double the pace of US growth to 4%. If the price tag is breaking the norms that have defined the Presidency and America’s role in the world in the post-war era, well, that’s a fair exchange, or so the optimists argue.

But the path from today to a potentially stronger run of growth is fraught with risk from unintended consequences that may flow from Trump’s bull-in-a-china-shop leadership style. There’s also the hard economics that leave some analysts scratching their heads about the prospects for assuming that substantially higher growth is fate. For example, CNBC reports:

While President Donald Trump‘s economic plan may provide some growth, the real driver of the country’s economic expansion is productivity, bond guru Bill Gross told CNBC on Friday.

And he’s not convinced that will pick up as much as is necessary.

“Productivity needs to grow at least by 2 to 3 percent, because the labor force is only growing at a half a percent,” the manager of the $1.7 million Janus Global Unconstrained Bond Fund said. “I’m skeptical.”

Meanwhile, Europe is facing its own internally grown rise in political risk. Echoing the populist revolution in Washington, fissures in the European Union look set to come to a head this year. Last year’s UK vote to leave the EU was the opening bid in what could prove to be a nasty struggle to keep the currency bloc intact.

The next hurdle: upcoming elections in France, where Marine Le Pen, the far-right politician who wants France to leave the European Union, is leading in recent polls. Worries over that possibility appear to be driving investors into the safe-haven trade of German bonds.

A populist wave could also bring anti-EU governments to power in Germany, Italy and elsewhere in Europe in the months ahead. Even if the status quo prevails, economic challenges in Italy and Greece will further strain the euro under the weight of hefty debt loads. Pricing in what could be a new phase of challenges, European bond markets have been sinking.

“The yield on Italy’s benchmark 10-year note — which moves in the opposite direction of its price — has doubled to 2.3% since late last fall,” The New York Times reports. “The yield on the equivalent Greek note has jumped to nearly 8% from 6.7% at the beginning of the year.”

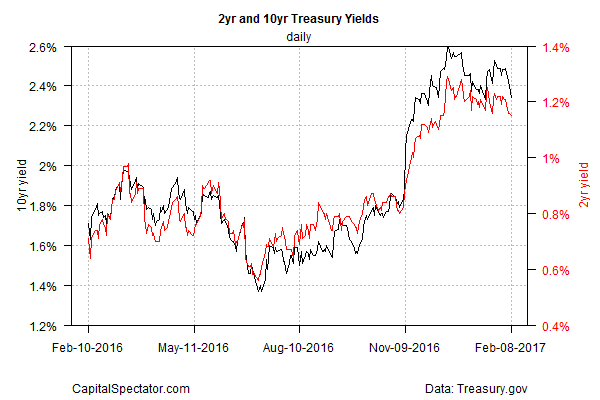

In the US, Treasury yields remain mostly stable after rising in recent months, partly on the assumption that growth will pick up once Trump’s policies are implemented. If that rosy outlook falters, expect to see yields tumble. The benchmark 10-year yield has weakened a bit lately, but the 2.34% rate as of yesterday (Feb. 8) is still well above the roughly 1.80% yield that prevailed on the eve of Trump’s election. If the 10-year rate falls below 2.0%, that would be a sign that the crowd is having second thoughts about the Trump-inspired forecasts of stronger growth.

The good news is that the current numbers still point to a US economy that’s on track to grow at a moderate pace in this year’s first quarter. Four-percent growth, however, is nowhere in sight.

The question is whether Trumponomics is the real deal? The stakes are certainly high. If forecasts of faster growth turn out to be hot air, the market may lose its capacity for tolerating elevated geopolitical risk. The crowd has been willing to abide a President who spends political capital with abandon. But the calculus for pricing assets may become increasingly harsh if economic results fall well short of expectations.

“Global growth is resilient, but it is not shock-proof,” notes Larry Hatheway, chief economist at GAM Investment Solutions. “The key question for 2017, therefore, is whether populist politics will derail the global expansion?”

Pingback: When Does the Rising Supply of Unease Become Too Much to Handle? - TradingGods.net

can you add me to your regular email list please

Pingback: 02/10/17 – Friday’s Interest-ing Reads | Compound Interest-ing!

Terry,

To receive email updates of new blog posts, enter your email address in the subscribe field in the upper right-hand corner of the home page.

–JP