The case for raising interest rates is wobbly at best, but the Federal Reserve may start the squeezing process at its monetary policy meeting next week. Exhibit A for the hawkish view is the encouraging rise in nonfarm payrolls in October and November. The problem is that there’s no shortage of data that paints a softer profile, including the Atlanta Fed’s GDPNow model, which is currently projecting (as of Dec. 4) a tepid 1.5% rise in US GDP for the fourth quarter.

“The unfortunate thing is that if you raise interest rates there is a risk — again, it may be small, but it’s a significant risk — that you will slow down the recovery,” economist Eric Maskin, who won the Nobel in economics in 2007, told Bloomberg yesterday. “Maybe she knows something that I don’t know, and she sees signs of inflation I don’t see, but I really don’t understand why it’s so important to raise interest rates when there is so little to be afraid of.”

Even on the employment front the recent news on payrolls may be overstating the case for growth. Two updates this week for a pair of multi-factor benchmarks that measure activity in the labor market suggests that the job growth is weaker than it appears via the government’s monthly numbers. The Conference Board’s Employment Trend Index posted its biggest monthly drop in November since the Great Recession, which “suggests caution in extrapolating the current trend of job growth,” the consultancy advised. Meanwhile, the Federal Reserve this week reported that its Labor Market Conditions Index ticked lower last month, dipping to its lowest reading in seven months.

Surveying a wide mix of figures, Harvard’s Larry Summers wrote earlier this week that the macro profile at the moment “leaves me far from confident that there is substantial scope for tightening in the US.”

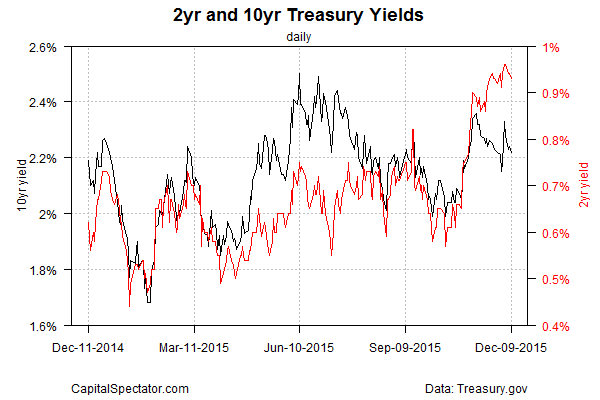

Reasonable or not, interest rates are hinting that a rate hike is near. It’ll be interesting to see if rates hold up (or not) in the days ahead as the investment world focuses on next Wednesday’s Fed announcement. Meanwhile, here’s how the key yields stack up. Let’s start with the 2- and 10-year Treasury yields. The rate-sensitive 2-year is still holding above the 0.9% mark as of yesterday (Dec. 9), which is more or less a five-year high. By comparison, the benchmark 10-year yield continues to trade in a middling range relative to recent history—and far below the five-year high of around 4% that was set back in 2010. Nonetheless, the 10-year has bounced off its recent lows, albeit modestly so.

The effective Fed funds rate is starting to creep higher too. The 30-day moving average has recent started ticking higher again for the first time in three months. Meantime, Fed funds futures are pricing in an 87% probability of a rate hike next week, according to CME data.

Yields across the Treasury curve have increased as of yesterday vs. 30 trading days earlier, confirming that there’s a broad-based upside bias in progress, if only slightly.

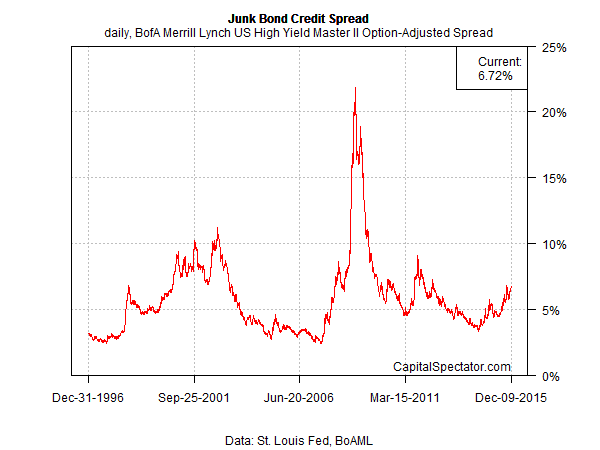

Unsurprisingly, the yield spread in junk bonds over investment-grade debt is trending higher in the current climate. The BoA Merrill Lynch High Yield Master spread inched up to 6.72% yesterday. Although that’s slightly below the recent high of 6.83%, the selling of junk bonds has pushed the spread close to its highest level since 2012.

“Higher interest rates are coming, and no one can deny it,” writes a columnist at MarketWatch. Actually, higher rates are already here. The only question: Will the Federal Reserve confer official status on the trend next week by formally raising its target Fed funds rate above the current zero-to-0.25% range?

Pingback: Case for Raising Interest Rates Is Wobbly