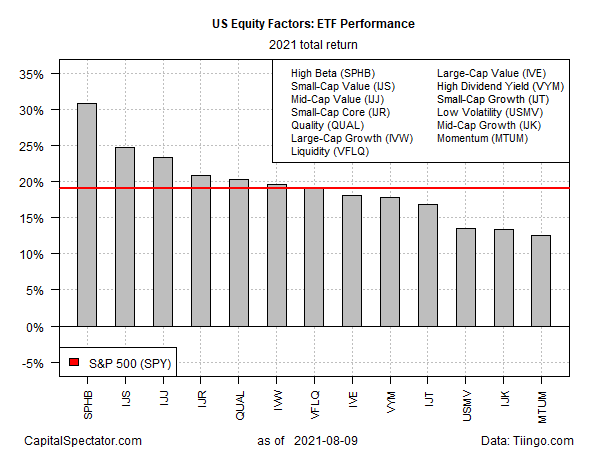

The strategy of holding stocks with the highest beta risk have stumbled recently, but remain comfortably in the lead year to date for US equity factors, based on a set of exchange traded funds.

Invesco S&P 500 High Beta (SPHB) is up 30.9% so far this year through yesterday’s close (Aug. 9). That’s well ahead of the second-best factor performance via iShares S&P Small-Cap 600 Value (IJS), which is ahead 24.7% in 2021.

SPHB’s performance edge is even stronger vs. the standard equities benchmark: SPDR S&P 500 (SPY) is up 19.0% year to date.

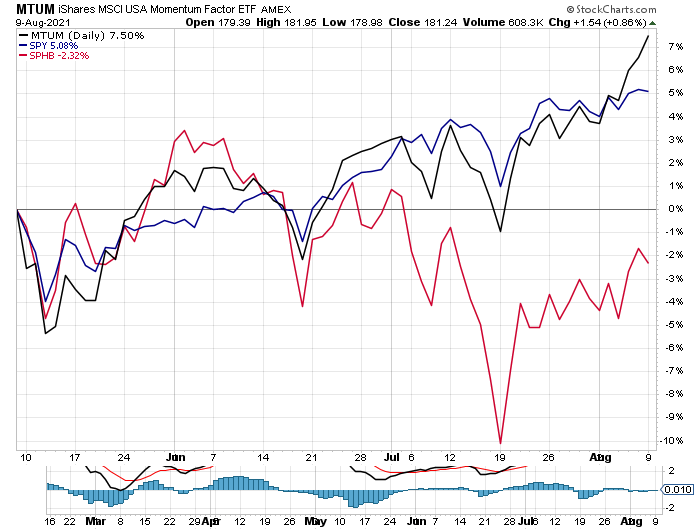

SPHB’s recent trading behavior, however, looks shaky compared with the market overall. The high-flying ETF began to stumble in June and has been trending lower even since. For much of the past month, SPHB has traded below its 50-day moving average, a possible warning sign for the fund’s near-term outlook.

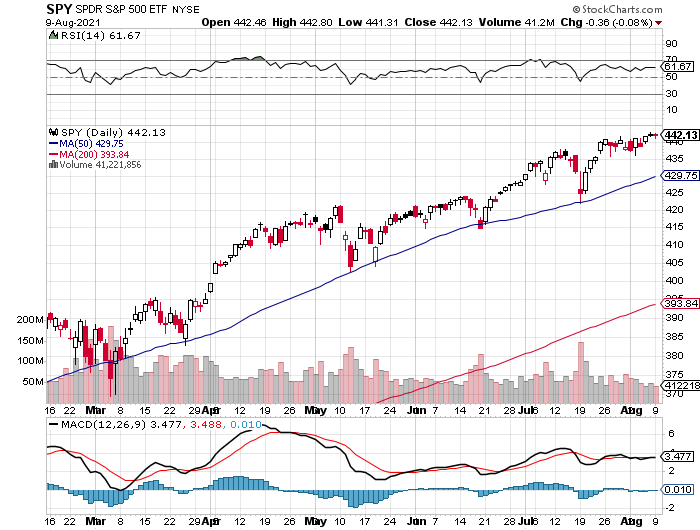

SPDR S&P 500 (SPY), by contrast, continues to trend up with relatively stable persistence.

In a sign of the times, all the factor funds on our list continue to post gains. The weakest performer: iShares MSCI USA Momentum Factor (MTUM), which is up a relatively moderate 12.5% year to date. Note, however, that MTUM appears to be regaining its upside mojo and has outperformed SPHB and SPY lately. MTUM’s recent bounce is especially conspicuous over the trailing three months: the fund is up 7.5%, slightly outperforming the US equities benchmark (SPY) while crushing SPHB, which has lost 2.3% since May 9.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Stocks with High Beta Risk Remain in the Lead - TradingGods.net

Pingback: US Equity Factor Returns This Year Guided by High Beta Stocks - TradingGods.net