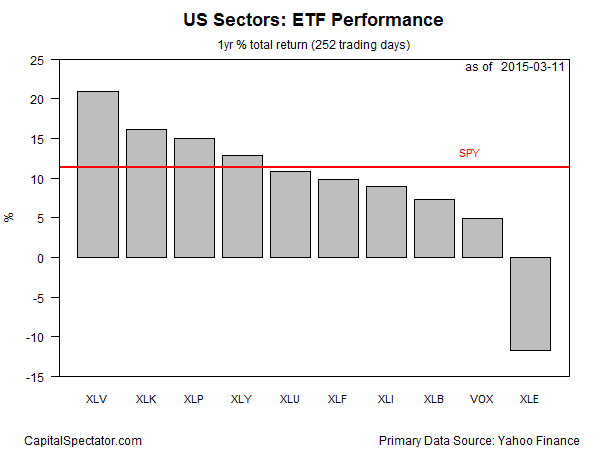

US equities have been trending lower so far in March, and no sector has been immune to the selling. But the relative strength in healthcare stocks continues to stand out. Energy companies, meanwhile, are still the weakest corner of the market among the major equity sectors, based on a roundup of trailing 252-day (1 year) periods through Mar. 11 via our usual set of ETF proxies.

The 20.9% trailing 1-year total return for Health Care Select Sector SPDR (XLV), although a solid gain, has been squeezed a bit in the wake of general market weakness. Earlier this year XLV had been ahead by as much as 30% over the previous 12 months.

It’s another story entirely for the Energy Select Sector SPDR (XLE), which continues to wallow in last place among US sectors in terms of performance. This ETF has shed nearly 12% on a total return basis for the past year through yesterday (Mar. 11), which translates into a performance that’s distinctly weaker compared with the rest of the field.

Relative to the broad market, only four of the ten major sectors are ahead of the SPDR S&P 500 (SPY), which is higher by 11.3% for the trailing one-year period through Mar. 11.

Here’s a look at how the trailing one-year performance histories compare by indexing all the sector ETFs to 100 as of Mar. 12, 2014. Note that all the funds have suffered lately.

Finally, here’s a recap of recent momentum for the sector ETFs via current prices relative to their trailing 50- and 200-day moving averages, as shown in the next chart below. For example, Energy Select Sector SPDR ETF (XLE) closed yesterday at nearly 14% below its 200-day moving average (black square in lower right-hand corner) and roughly 3% below its 50-day moving average (red square).

Here’s a list of the sector ETFs cited above, with links to summary pages at Morningstar.com for additional research:

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financial (XLF)

Healthcare (XLV)

Industrial (XLI)

Materials (XLB)

Technology (XLK)

Utilities (XLU)

Telecom (VOX)