The year so far is shaping up to be quite different from 2024 in terms of leaders and laggards for the major asset classes. Global equities ex-US are the leaders, along with a broad measure of commodities, based on a set of ETFs through Friday’s close. The formerly high-flying US equities market, by comparison, is posting relatively modest results year to date.

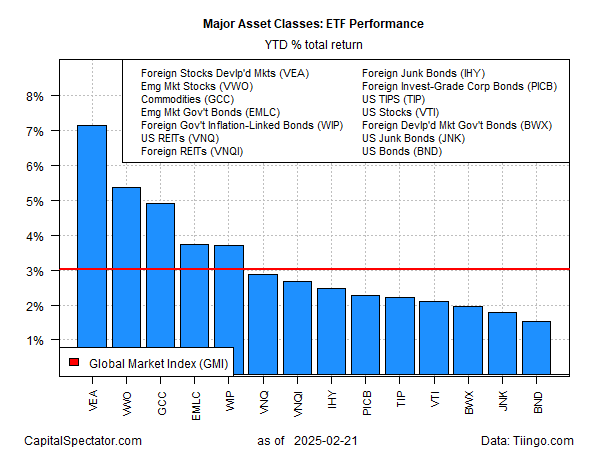

Foreign shares in developed markets continue to post a wide lead over the rest of the field. Vanguard FTSE Developed Markets ETF (VEA) has rallied 7.2% so far this year. Emerging markets stocks (VWO) are in second place, rising 5.4%, followed by commodities (GCC) in third place at 4.9%. US stocks (VTI), meanwhile, have fallen toward the back of the line with a relatively modest 2.1% gain.

For context, the Global Market Index (GMI) is up 3.0% so far this year. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios.

A couple of months could be noise, of course, and so it’s too soon to draw solid conclusions from the year to date numbers. But in a world of rapidly changing political and economic conditions, this may be am early clue that the crowd’s outlook is pivoting away, if only on the margins, from the US-led order that’s prevailed in global markets in recent years.

US shares have been leaders over the rest world for so long as to inspire questions about whether international diversification is worthwhile. The relative strength in equities ex-US so far this year is inspiring some analysts to forecast a turning point that highlights the delayed but reviving power of mean reversion and global diversification.

“The pendulum swung too far in favor of US exceptionalism and too negative outside of the US,” advises Robert Ruggirello of Brave Eagle Wealth Management. “Coming into the year: tariffs, China’s bad, China regulation, all of this stuff. And it’s sort of reverting back to the mean now.”

Taking a strategic view and adopting some degree of global diversification, however, has been difficult over the past decade, observed Larry Swedroe, a veteran portfolio analysts. Writing for Morningstar last month on the pros and cons of international diversification, he advised:

“The bottom line is that while the prudent strategy is to globally diversify, investors will likely fall prey to recency bias and abandon even a well-thought-out plan, likely at the wrong time—unless the mistake of resulting (judging the quality of a decision by the outcome instead of the decision-making process) can be avoided.”