A slightly lower US Dollar Index last week gave foreign bonds an edge among the major asset classes, based on a set of proxy ETFs. Inflation-indexed bonds in foreign markets led the way higher for the five days of trading through Friday, Nov. 13. The top performer for the week just passed: SPDR International Government Inflation-Protected Bond ETF (WIP), which gained 0.9%. In fact, the top-four ETF leaders last week for the major asset classes are in the foreign bond category.

Last week’s big loser: emerging market stocks. The Vanguard FTSE Emerging Markets ETF (VWO) slumped nearly 5% over the five trading days through Friday. The retreat marks a sharp reversal after the previous week’s gain, which briefly inspired hope in some corners that this long-battered slice of the global equity market was stabilizing. The latest drubbing, however, reaffirms what has been obvious for some time: negative momentum continues to weigh on emerging market stocks overall and there’s still no sign that the descent has run its course.

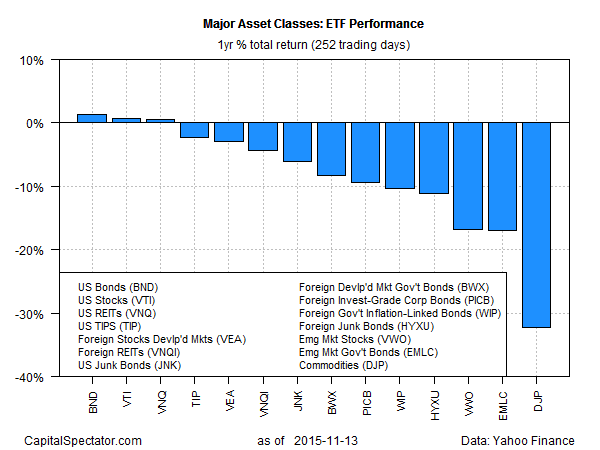

Gravity is also keeping most of the major asset classes under water for the trailing 1-year period through Nov. 13. Of the 14 slices that comprise the global asset pie, only three have posted slight gains for the past year—US bonds (BND), US stocks (VTI), and US real estate investment trusts (VNQ). Meanwhile, broadly defined commodities (DJP) continue to suffer as the red-ink leader, falling a hefty 32% over the last 12 months.

The new week starts with a fresh dose of negativity, due to last week’s horrific bombings in Paris–a reminder that geopolitical risk remains a factor in the West. Meanwhile, we learned over the weekend that Japan slipped back into recession in the third quarter. The news reaffirms the view that the global economy remains vulnerable to the usual suspects—slow/negative growth and disinflation/deflation.

The US outlook offers a comparatively firmer outlook at the moment. The Atlanta Fed’s GDPNow model is currently projecting that fourth-quarter GDP growth will rebound a bit to 2.3% (as of the Nov. 13 estimate). That’s a modest pace, but at least it’s up from Q3’s sluggish 1.5% rise.

Fulcrum Asset Management last week argued that a gloomy outlook for the global economy overall is excessive at this stage. For a variety of reasons the London-based money manager advised that deflation risks “now appear to be abating.”

Global industrial production has recovered, inflation has bottomed in the advanced economies, and China has stabilised its currency ahead of likely entry into the SDR. Although longer term deflationary risks still remain, the latest deflation scare, driven mainly by commodity prices, may be ending.

A degree of support can be found in the October survey data for the global manufacturing and services sectors. As Markit Economics noted earlier this month, last month’s data signaled a “modest acceleration in the rate of global economic expansion.”

Will the modest revival continue in November? The crowd will be keenly watching for signs in the upcoming economic data, and in this week’s market action.