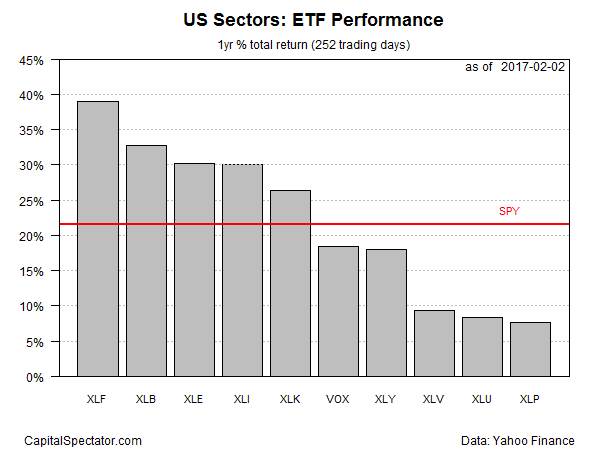

The recent decline for the formerly high-flying energy patch has left financial stocks in the lead among US equity sectors for one-year total return, based on a set of proxy ETFs.

Financial Select Sector SPDR (XLF) is up a sizzling 38.9% over the past 252 trading days through yesterday (Feb. 2). The lion’s share of XLF’s gain has unfolded in the three months since Donald Trump won the election last November. Note, however, that this top performance is only slightly ahead of the number-two fund: Materials Select Sector SPDR (XLB), which is ahead by 37.2% on a total return basis for the past year.

Energy stocks continue to enjoy a robust one-year gain, but selling has picked up in recent days, leaving the Energy Select Sector SPDR (XLE) in third place with a 34.8% rise vs. the year-earlier price. Just a month ago the fund was decisively in the lead for US sector performance for the trailing 12-month window.

The weakest performer among US sectors at the moment for trailing one-year results: consumer staples. Although Consumer Staples Select Sector SPDR (XLP) is up a respectable 7.4% for the trailing one-year period, the performance looks quite weak relative to the rest of the field these days.

Indeed, even the broad US equity market is currently higher with a solid 22.4% total return over the past 12 months, based on the SPDR S&P 500 (SPY) — more than double the market’s long-term performance.

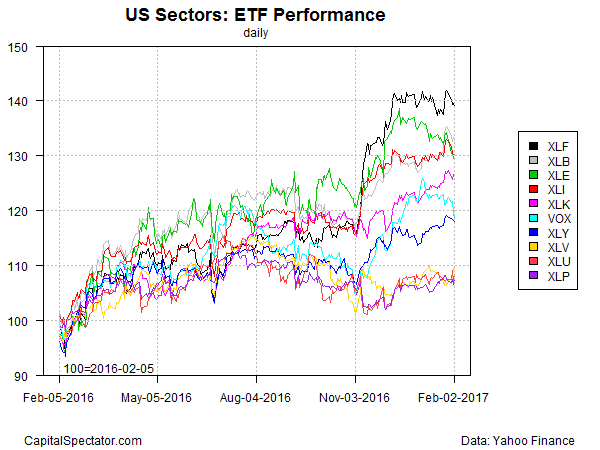

XLF’s leadership position of late (black line at top in chart below) is partly due to XLE’s recent slide (green line), as shown below.

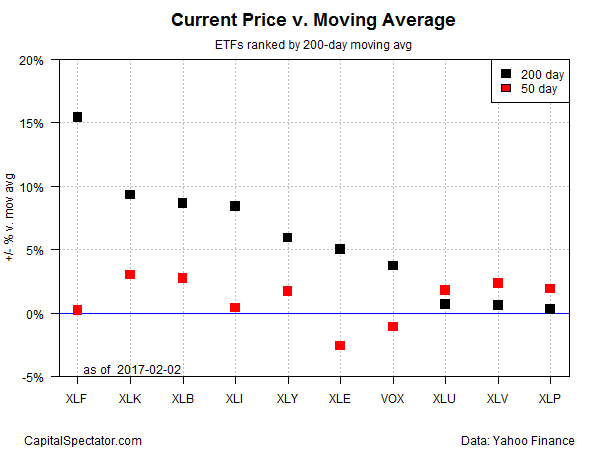

XLF’s bullish momentum is conspicuous when measured by its current price vs. the 200-day average. The ETF is currently trading more than 15% above that trend line. By comparison, the fund is just about even with its 50-day average, which may be a sign that Financial Select Sector SPDR is heading into a period of turbulence if the fund falls below that mark in the days ahead.

For additional research on the sector ETFs cited above, here are links to the summary pages at Morningstar.com:

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financial (XLF)

Healthcare (XLV)

Industrial (XLI)

Materials (XLB)

Technology (XLK)

Utilities (XLU)

Telecom (VOX)