Following last week’s softer-than-expected increase in US private-sector payrolls in December, the Federal Reserve yesterday reported that its Labor Market Conditions Index (LMCI) dipped into negative terrain for the first time in seven months. Although the slightly negative reading remains well above levels associated with economic recession, the latest decline corroborates the deceleration in employment growth that’s been conspicuous in the year-over-year pace for payrolls in recent history.

LMCI, a multi-factor measure of employment activity, fell to -0.3 last month, the lowest reading since May’s -3.3. The news follows Friday’s release of December data for nonfarm payrolls, which posted a 1.63% annual increase—the slowest gain in more than five years.

The Conference Board’s Employment Trends Index (ETI) also dipped last month, although an analyst at the consultancy said that the outlook for 2017 was still encouraging.

“After strong growth over the previous three months, the Employment Trends Index declined slightly in the final month of 2016,” said Gad Levanon, chief economist, North America, at The Conference Board. “However, the ETI’s trend suggests that job growth will remain solid in early 2017. And, employers have become more upbeat in recent months, suggesting the labor market may very well tighten faster than pre-election expectations.”

The outlook based on jobless claims—a leading indicator for the labor market—certainly looks encouraging. New filings for unemployment claims remain close to the lowest level since the early 1970s, suggesting that employment growth will continue in the new year.

Meanwhile, recession risk remains low for the US, based on recent data, and the upbeat signal was reaffirmed in this week’s update of the US Business Cycle Research Report, which monitors macro risk across several benchmarks, including the Philly Fed’s ADS Index and the Chicago Fed National Activity Index.

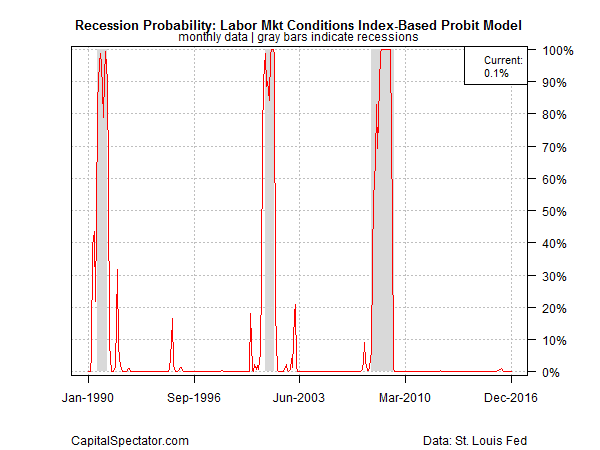

As for LMCI, the estimated recession risk probability associated with this data ticked up fractionally in December, but the roughly 1% reading based on probit modeling implies that the US economy remained solidly in an expansionary mode at the close of 2016. In short, LMCI would have to fall significantly deeper into the red to raise a genuine warning flag.

Nonetheless, the next round of GDP data for last year’s fourth quarter (due on Jan. 27) is expected to reflect a moderate slowdown in growth. The Atlanta Fed’s current nowcast for Q4 GDP (as of Jan. 6) points to a 2.9% pace, down from 3.5% in Q3. Meanwhile, the New York Fed’s Jan. 6 nowcast projects a sluggish gain of just 1.9%.

The US is in no immediate danger of slipping into a new NBER-defined recession, but the analysis doesn’t preclude a downshift in economic activity. Optimistic forecasts, however, tell us that President-elect Donald Trump’s policy plans for tax cuts, lighter regulation, and infrastructure spending will raise growth. A new Deutsche Bank projection, for instance, advises that US GDP’s pace may double by 2018.

“This policy mix has the potential of reigniting productivity growth and raising U.S. growth potential,” David Folkerts-Landau, chief economist at Deutsche Bank, wrote in a report, CNBC reports. “While Trump introduces higher uncertainty, this is better than the near certainty of the continuation of a mediocre status quo.”

Higher growth would certainly be welcome, but there’s a long way to go from soft estimates about what could happen and the current climate. The good news is that moderate growth is still likely for the near-term future. Anticipating something substantially better, meanwhile, remains firmly in the realm of speculation, even if it’s informed speculation.

But some economists recommend caution because “this is an economy that is at full employment right now,” observes Chris Rupkey, chief financial economist at MUFG Union Bank. “This is the economy we are going to have, and it’s very hard to see how Trump is going to double economic growth or create 25 million new jobs,” he tells Politico. “The problem is he’s wound the electorate up to have these expectations, and he won’t be able to do it because the economy won’t let him do it.”

Pingback: Labor Market Conditions Index Dipped into Negative Terrain - TradingGods.net