Is the Federal Reserve having second thoughts about tightening monetary policy? Weak economic data in recent weeks certainly provide excuses to delay any plans to start raising interest rates. Comments from Fed officials over the past week have dispensed mixed signals on the outlook, although some policymakers say the reported divisions on monetary policy opinion are exaggerated, according to Reuters. Maybe, but the latest numbers on the US monetary base (M0) and the effective Fed funds rate suggest that the central bank is pulling back a bit from what appeared to be a clear shift towards tighter policy posture in recent months.

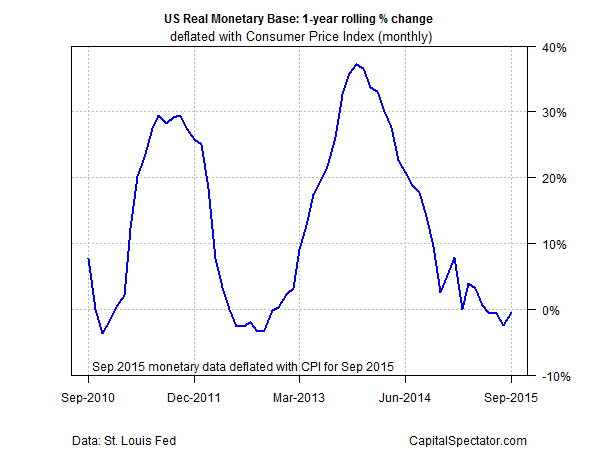

The US monetary base in real terms continued to fall in September vs. the year-earlier level, but at a slightly lesser pace. The fractional 0.5% annual decline last month in inflation-adjusted M0 compares with a 2.5% year-over-year slide in August. Is that a clue for thinking that the Fed is unsure about pushing ahead with a rate hike?

Compared with the hefty year-over-year gains in the monetary base that prevailed until recently, the latest changes are trivial. Yet if policymakers are intent with moving ahead full steam with a rate hike wouldn’t the annual pace of M0 continue to descend further into the red in order to reverse course after the unusually high growth rates previously? Maybe not, especially if any poilcy squeeze will be slight. In any case, M0’s annual change is still negative… for the fourth month in a row. Perhaps this means that the Fed is keeping its options open.

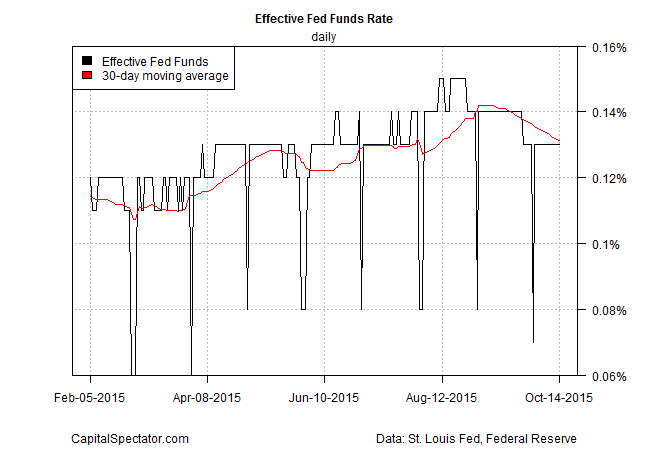

Meantime, the effective Fed (EFF) funds rate continues to trend lower. After ticking higher through most of the five months through the end of August, EFF’s 30-day average has been slipping through Oct. 14. Another sign that the Fed is getting cold feet on plans to begin squeezing interest rates?

Cleveland Fed President Loretta Mester yesterday said that the US economy “can handle” a rate hike. “It is appropriate for monetary policy to take a step back from the emergency measure of zero interest rates,” she noted in a speech yesterday. Maybe, but the latest numbers on real M0 and EFF leave room for doubt for expecting that the “step back” is imminent.