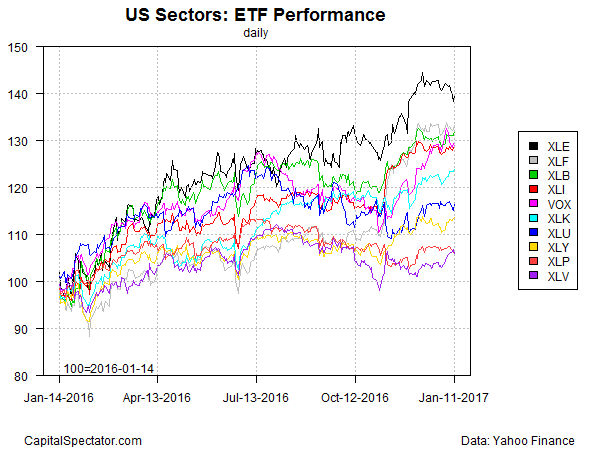

The rebound in energy shares since the November election has backtracked slightly in 2017, but these stocks still hold the top spot for one-year total return (252 trading days) for US sectors through Jan. 11, based on a set of proxy ETFs.

Energy Select Sector SPDR (XLE) is up nearly 40% over the past year, roughly double the gain for the US stock market overall. A key factor driving XLE’s rally is the rise in crude oil prices. A barrel of West Texas Intermediate, the US benchmark, is up nearly 70% over the past year.

Health care stocks, by contrast, are posting the smallest gain for US sectors over the past year. Health Care Select Sector SPDR (XLV) is ahead by just 5.6% for the trailing 252-trading-day period.

The broad trend for equities, by contrast, is considerably stronger via the SPDR S&P 500 ETF (SPY). The fund is currently higher by nearly 20% over the last 12 months.

XLE’s upside momentum is clearly in the lead at the moment for trailing one-year results vs. the rest of the field, as the next chart shows.

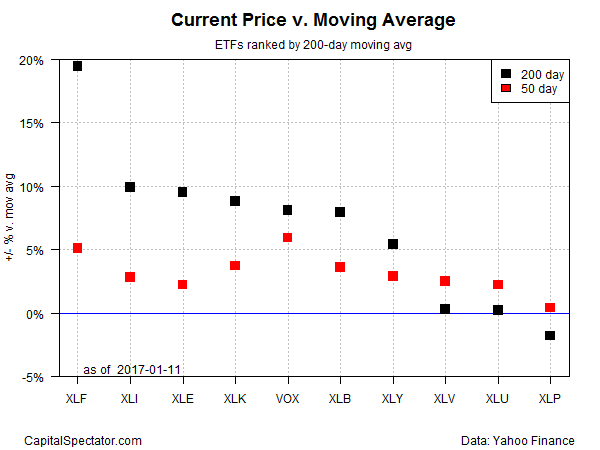

Note, however, that financial stocks boast the strongest performance among the sector ETFs in terms of price relative to 200-day moving average. Financial Select Sector SPDR (XLF) is currently trading at roughly a 20% premium over its 200-day average—far above the comparable spread for the other sector ETFs. Meanwhile, at the opposite end of the spectrum, Consumer Staples Select Sector SPDR (XLP) is trading below its 200-day average—the only sector ETF with negative momentum via this yardstick.

For additional research on the sector ETFs cited above, here are links to the summary pages at Morningstar.com:

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financial (XLF)

Healthcare (XLV)

Industrial (XLI)

Materials (XLB)

Technology (XLK)

Utilities (XLU)

Telecom (VOX)

Pingback: Rebound in Energy Shares Since November - TradingGods.net