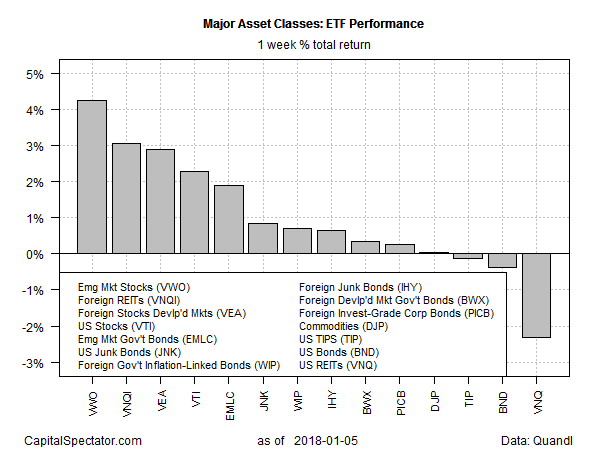

Equities in emerging markets posted the strongest return for the major asset classes in 2018’s first week of trading, based on a set of exchange-traded products. The losers for the year-to-date performance so far are limited to US bonds and US real estate investment trusts (REITs).

Vanguard FTSE Emerging Markets (VWO) led the field higher with a sizzling 4.2% gain last week. The increase marks the ETF’s fifth consecutive weekly advance and the strongest since last July.

Stronger commodity prices and US-dollar weakness are factors driving stocks higher in emerging markets, notes Koon Chow, a strategist at UBP, a Swiss private bank. “That’s providing a macro tailwind for emerging markets – oil and global trade both speak to stronger emerging markets exports and emerging markets growth, which helps lift people’s expectations on a whole range of EM assets.”

US REITs suffered the biggest stumble last week among the major asset classes. Vanguard REIT (VNQ) lost 2.3%, the second straight weekly setback in the last three weeks for securitized real estate shares.

“Expectations of stronger economic growth and higher inflation have pressured yield-sensitive sectors,” according to Hoya Capital Real Estate, an investment advisor that focuses on commercial real estate securities.

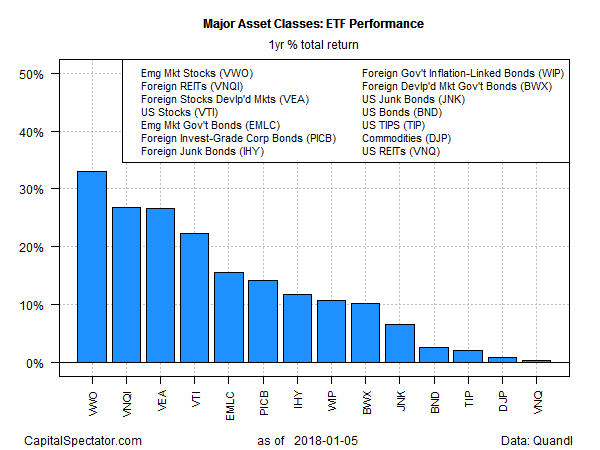

For the one-year trend, emerging markets stocks continue to hold the top spot in this corner too. VWO is ahead by 33.0% as of Friday’s close (Jan. 5) vs. the year-ago price after factoring in dividends.

Note that all the fund proxies for the major asset classes are posting gains for the one-year change through last week. The weakest return is for US REITs: VNQ is ahead by a razor-thin 0.3% for the past year.