The Republican brand is up this morning and Mr. Market’s stress level is down. Is there a connection? Probably not, but for the moment the pairing is conspicuous. Then again, if the GOP has a pro-growth agenda that makes a difference in the real economy, well, maybe there’s a degree of logic behind the market’s bullish makeover of late. We’ll see. In any case, Republicans took control of the US Senate and extended their hold on the House of Representatives in yesterday’s election. Meantime, last month’s surge in volatility continues to subside as of yesterday (Nov. 4).

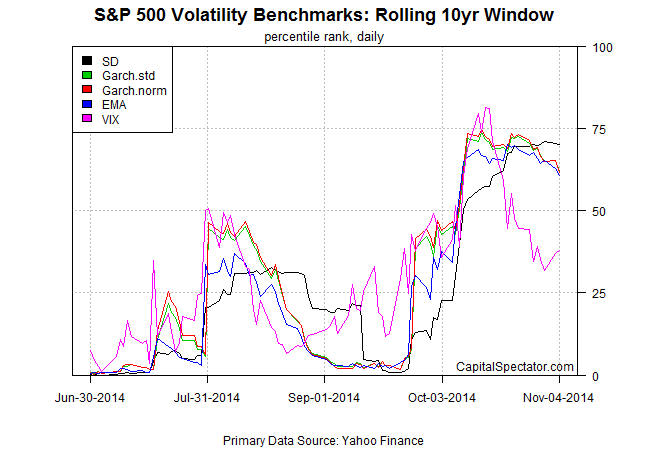

Several measures of US stock-market volatility (see definitions below) look less threatening these days, as seen through the prism of percentile rank (a statistical tool that puts the numbers on an equal footing for easy comparison). The market’s estimate of near-term volatility in the future – the VIX Index – has had the biggest retreat lately. Backward-looking metrics, by contrast, are still elevated, but several are beginning to fade as well, based on a rolling three-year historical window.

Volatility is also easing when measured through a 10-year look-back window, which offers a more robust measure of vol in terms of historical context.

Considering the current climate, it’s no surprise to see the high-yield spread turn lower these days. After jumping to just over 5% in mid-October – the highest in over a year – the BofA Merrill Lynch Option-Adjusted Spread has beat a hasty retreat in recent weeks.

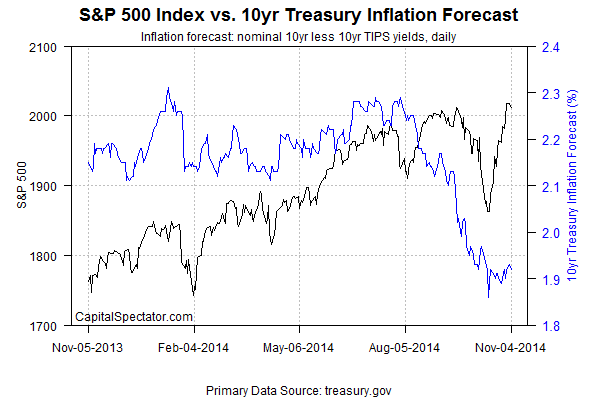

Mr. Market’s spirits have clearly revived after last month’s brief but intense detour into despair. Why, then, hasn’t the crowd raised its outlook for inflation (based on the yield spread between nominal and inflation-indexed 10-year Treasuries)? The recent tumble certainly wasn’t encouraging at a time when Europe is struggling with economic stagnation.

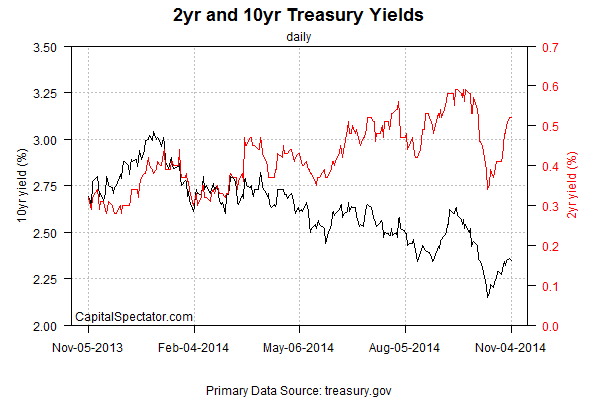

The US economy, however, continues to look resilient, as indicated by the broad macro trend and the solid rise in third-quarter GDP. All of which implies that the Treasury market’s subdued forecast for inflation is excessive. Indeed, when we look to Treasury yields directly, the crowd’s of a mind to raise interest rates. The benchmark 10-year Treasury yield has been climbing steadily since mid-October, settling at 2.35% yesterday—close to the highest level in nearly a month. The 2-year yield, which is considered to be a more sensitive measure of rate expectations, is also increasing, reaching 0.52% yesterday, which is also the most in nearly a month.

The bottom line: the soft inflation forecast via the Treasury market looks like a quirk linked to trading in TIPS (inflation-linked Treasuries). Unless this Friday’s payrolls report for October tells us otherwise, it’s reasonable to assume that the US economy is still poised for moderate growth. The macro case for a lesser degree of financial stress, in short, is warranted vs. October’s peak.

Optimism, by the way, also seems to describe the mood on Main Street, according to Gallup’s latest poll. The firm’s Economic Confidence Index, which measures Americans’ view of current conditions, reached its highest level in over a year in the October reading.

For the moment, Mr. Market’s brief freak-out last month doesn’t appear to be a sign of deeper troubles in the macro trend.

***

The percentile rank data is calculated in R with the runPercentRank function. The five measures of S&P 500 volatility cited above are defined as follows:

VIX: market expectation of near term volatility for S&P 500 based on index option prices.

EMA: 30-day exponential moving average of the S&P 500’s squared daily % return.

SD: 30-day standard deviation of the S&P 500’s daily % return

Garch.norm: a Garch(1,1) model that assumes a normal distribution via the rugarch package in R.

Garch.std: a Garch(1,1) model that assumes a “fat-tail” distribution based on a Student’s t-distribution via the rugarch package in R.

Pingback: Downsizing Market Stress – The Capital Spectator | Marty Investor