Yesterday’s news that the ISM Manufacturing dipped a bit deeper into the red zone in December raised new questions about the strength of the US economy. This widely followed benchmark fell to 48.2 from 48.6 in November. The slide marks the second straight month of below-50 readings, which indicates contraction. US manufacturing activity, in other words, is stumbling along at the weakest pace in six years.

“As the impact of the strong dollar and weak global demand continues to play out, it’s no surprise that we’re seeing these kinds of sub-par prints in manufacturing,” said Millan Mulraine, deputy head of US research and strategy at TD Securities, via Bloomberg. “As low energy prices continue to have an impact on the energy sector, then we’re likely to see a weak showing in manufacturing for a long time.”

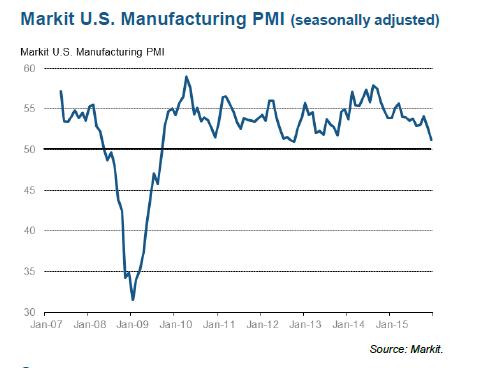

A competing benchmark—Markit’s purchasing managers’ index (PMI)—offered a modestly stronger profile for manufacturing at 2015’s close. But here too there are clear signs of accelerating weakness, albeit in the form of slower growth, according to this data. Although the PMI remained above the neutral 50 mark that separates growth from contraction, the slide to 51.2 last month is the lowest in more than three years and the downward momentum of late suggests that a dip below 50 in the months ahead is a distinct possibility.

“The manufacturing sector saw a disappointing end to 2015, and its plight looks set to continue into the New Year as headwinds show no sign of abating any time soon,” advised Chris Williamson, chief economist at Markit.

After reading the lastest numbers the usual suspects quickly declared that the end is nigh for the US recovery. Perhaps, but a convincing case is still wobbly for assuming that a new recession is fate. The potential for trouble is certainly higher as we begin the new year, but it’s premature to argue that the die is cast for the business cycle if the standard for deciding is objective econometric analysis. Why? For starters, manufacturing alone doesn’t claim a monopoly on representing the broad macro trend. Yes, it’s a key sector and it has been known to offer early clues of an approaching storm. But as I noted last month, the long history of the ISM Manufacturing Index also reveals that this benchmark has dispensed numerous false alarms as well through the decades in terms of signaling an NBER-defined recession.

Keep in mind, too, that when we look at a broad profile of US economic indicators, growth still has the upper hand. For instance, consumer spending in November looked encouraging and Gallup’s survey data for December implies that the finale for 2015 will remain upbeat.

Cherry-picking indicators is always a risky affair, of course, but several broadly defined business-cycle benchmarks also point to an ongoing if somewhat battered expansion at the moment. (See the Philly Fed’s ADS Index, the Chicago Fed’s National Activity Index, and The Capital Spectator’s proprietary metrics for details.)

The question is whether manufacturing’s stumble is a prelude to a robust signal that the US economy has slipped over to the dark side? Possibly, but we’ll need more data. The December profile for the state of US macro is still thin beyond manufacturing survey numbers and Mr. Market’s heightened anxiety. But even taking the ISM data at face value leaves room for debate. Analyzing the ISM values in context with NBER’s recession signal history via a probit regression translates into a roughly 20% probability of a new downturn as of last month. That’s a relatively elevated level compared with recent history—and it’s also the highest since the last recession. But is it enough evidence to indict and convict? No, at least not yet.

Indeed, if we add other key economic indicators to the probit regression above—nonfarm payrolls, for instance—we find that recession risk falls below the level shown. But to the extent that this offers a basis for optimism—and it does—the analysis is subject to change.

In the days ahead we’ll see incoming December numbers that will confirm or deny the worrisome profile in manufacturing. Friday’s report on payrolls is the highlight for this week.

Meantime, the broad macro trend for the US remains in positive territory—based on published figures to date across a spectrum of indicators. That could change in the days ahead… or not. Maybe you’re inclined to guess what happens next—using only manufacturing data (and the wobbly stock market) as the primary clues. But that’s a precarious model. On the other hand, it’s timely. High-confidence business-cycle signals, by comparison, arrive with a lag. All of which leads us to a familiar choice: Pick your poison.

Pingback: 01/05/16 – Tuesday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Wednesday morning reads–H bomb | Writings on Wall St