And just like that, the formerly high-flying US tech sector is on the defensive. If you blinked, you missed it.

Anxiety about the competitive threat from Chinese artificial intelligence lab DeepSeek triggered a sharp selloff in US equities on Monday, with the worst of the decline centered in tech. Chipmaker Nvidia was especially hard hit, suffering a near-$600 billion loss of market cap in one day.

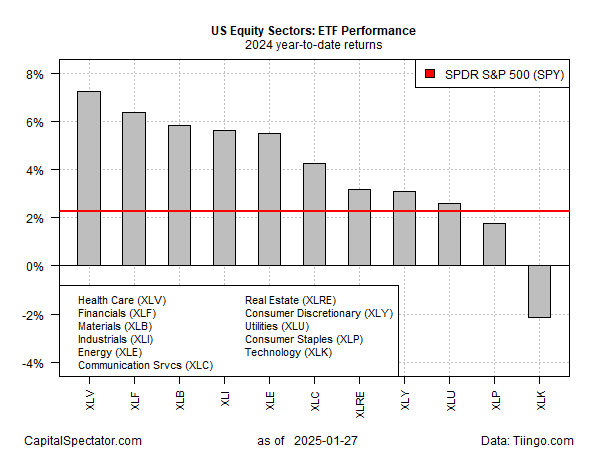

The selling weighed on a broad measure of tech stocks. Using a set of ETFs, tech is suddenly the weak outlier so far in 2025. Although much of the equities market took a hit on Monday, all non-tech sectors are still firmly in positive terrain for the year.

The new sector leader for 2025: healthcare (XLV), which is up 7.3% year to date. In fact, healthcare stocks soared yesterday: XLV popped more than 3% on Monday, a day when tech and other corners of the market were in the crosshairs of sellers.

The question is whether the new arrival of an AI threat from China is noise or a more substantial warning for US tech firms, which had been favored as leaders with minimal competition. It’s too early to know the answer, but the question is now front and center for the market, which previously assumed that Nvidia and other American stars of the AI ecosystem were relatively immune to change.

But change is the nature of tech, which has been (and will remain) the poster child for rapid evolution that upends norms, reorders competitive moats, and generally spawns disruption on a regular basis–quite often on a timeline that poses maximum pain for investors who are all-in on the hype du jour.

“DeepSeek has taken the market by storm by doing more with less,” says Giuseppe Sette, president at AI market research firm Reflexivity. “This shows that with AI the surprises will keep on coming in the next few years.”

One analyst thinks that the arrival of DeepSeek, which was founded in 2023, isn’t accidental. “The technology innovation is real, but the timing of the release is political in nature,” says Gregory Allen, director of the Wadhwani AI Center at the Center for Strategic and International Studies. He sees a connection with the growing tensions between the US and China.

This is “AI’s sputnik moment,” writes Silicon Valley investor Marc Andreessen, in a reference to the Soviet Union’s launch of an orbital satellite in 1957, an event that arguably marked the launch of the Cold War.

Yet some analysts think the market’s selloff is an overreaction. “I don’t think DeepSeek is doomsday for AI infrastructure,” says Bernstein managing director and senior analyst Stacy Rasgon.

Maybe not, but the AI-fueled tech sector will need to prove itself anew, and persuade investors that its wares and intellecutual capital aren’t far more vulnerable than previously assumed. At the moment, that’s a high bar. But this is tech, and so today’s assumptions are often tomorrow’s trashed expectations.

There’s also a view that Monday’s tech selloff wasn’t solely about DeepSeek, but related to sky-high valuations that strongly suggested AI hype had gone too far too fast–a view that’s suddenly the consensus.

“What makes Monday’s tech sell-off so jarring is that the valuations of many of these AI and tech companies offer no margin of error,” notes David Bahnsen, chief investment officer at The Bahnsen Group. “The excessive weighting these tech stocks have in many investor portfolios and the high concentration these tech stocks have in the market indices was a significant and under-appreciated risk issue.”