Gross domestic product (GDP) is down, but gross domestic income (GDI) is up. One hints at the possibility of a recession for the US while the other still points to growth, albeit at a lesser pace than we’ve seen recently. GDP retreated by 0.7% in the first quarter, but GDI—considered an alternate and arguably superior measure of economic activity—increased 1.4% (real seasonally adjusted annual rates).

Economist Justin Wolfers argues that GDI is a “better measure” of economic activity, in part because it’s “measured using somewhat higher-quality data [compared with GDP], and so it tends to yield more reliable signals.”

Minds will differ, of course—this is macroeconomics, after all. But while the debate will roll on, advocates of GDI say it offers support in favor of the view that the US didn’t flirt with a new recession in Q1.

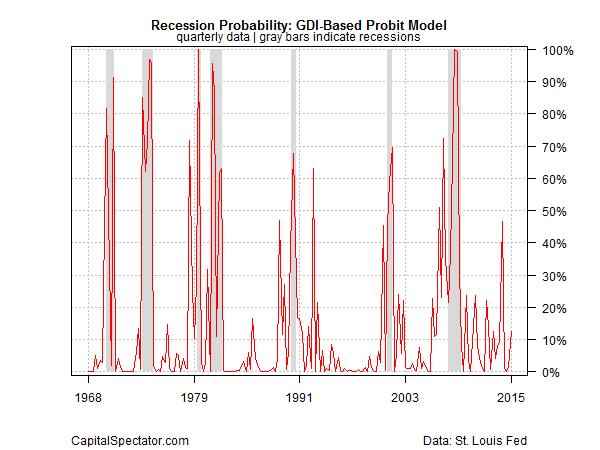

To put GDI on a relatively level playing field with GDP in terms of business-cycle signals, let’s run the quarterly changes for this alternative measure of economic activity through a probit model in search of context for deciding if Q1 has crossed the red line into contraction. The short answer: no, as the chart below shows. The current reading is quite low, at roughly 13% for this year’s first quarter.

The recession-risk estimate for GDP via a probit model looks considerably darker, of course, thanks to Q1’s slide, as I noted last week.

Which one’s telling us the truth? Let’s split the difference and for now say that the US trend turned softer in Q1 but is still short of a tipping point. That leaves us to ponder the case for a second-quarter rebound. The numbers overall are a bit shaky to date, but the monthly figures through April still translate into low odds that the NBER will declare the month as the start of a new downturn.

The main event for this week for revising the outlook (or not) is Friday’s payrolls report for May. The crowd’s looking for another respectable gain, based on Econoday.com’s consensus forecast—a rise of 215,000 for private payroll, up slightly from April’s 213,000 increase. If the prediction holds, the chatter about recession risk will fade while GDI’s reported advantages will draw more accolades.