The inverse relationship between prices and yields, if not quite a blessing, is at least useful. And so it’s been since our last update on trailing yields for the major asset classes via ETF proxies. As prices have fallen, some of the pain is offset by rising trailing yields.

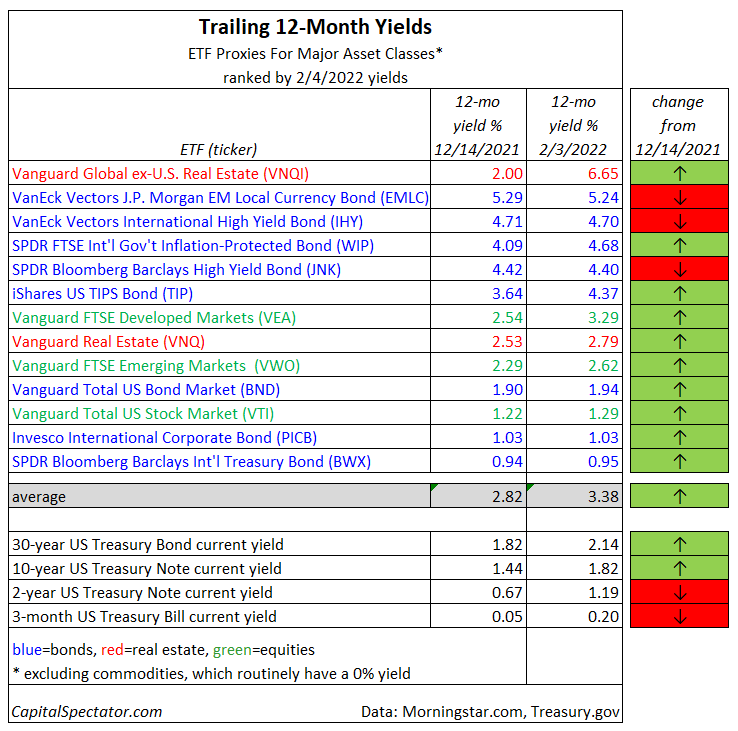

To be precise, investors deploying new capital into markets can take advantage of higher yields. In mid-December, the average yield for the major asset classes was 2.82%. In today’s update, the trailing yield has bumped up to 3.38%, or nearly twice as high as the current yield on the benchmark 10-year Treasury Note, based on data through Feb. 3 via Morningstar.com.

The range of trailing yields has widened for the underlying fund components, ranging from a low of 0.95% for government bonds in developed markets ex-US (BWX) to a hefty 6.65% for foreign real estate (VNQI).

The rise in yields is encouraging, but it didn’t arrive in a vacuum. Inflation has increased too, and rather sharply. Consumer prices in the US rose a hefty 7.0% for the year through December. In other words, all the yields in the table above are in the red in real terms (i.e., after adjusting for inflation).

Another caveat to keep in mind: trailing yields are a snapshot in time and indicate payouts received for holding assets in the past. Extrapolating that history into the future is a tricky business for all the usual reasons when it comes to forecasting trends for risk assets. To be blunt, yields over the past 12 months are no guarantee of comparable results over the next 12 months and so you’ll need to do more homework on specific funds beyond simply reviewing trailing results.

Nonetheless, monitoring yields across assets and through time offers context, and on that score it’s clear that the odds have increased that a multi-asset class portfolio of late offers the potential to generate a higher payout than we’ve become accustomed to in recent years.

The question is whether those payouts will continue to rise in 2022? That’s a clever way of asking: Will prices continue to fall? No one can rule out the possibility, which implies that keeping some degree of cash on the sidelines to take advantage of higher yields down the road is a reasonable strategy.

As The Economist observes this week: “Interest rates may have to rise sharply to fight inflation.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report